EAG Opens Lending Access for Seniors in Non-Compliant SB326 Condo Buildings

SB326 delays may block seniors from tapping home equity. EAG’s reverse mortgages help older condo owners unlock funds and retire securely despite HOA issues.

LOS ANGELES, CA, UNITED STATES, July 8, 2025 /EINPresswire.com/ -- For many older Americans, the home represents independence, stability, and the legacy of a life well lived. According to a 2025 survey by Point, 84% of older homeowners say aging in place is a priority, with 58% calling it critical.

But for many older Californians living in condominiums, that goal is now under pressure due to widespread delays in compliance with Senate Bill 326 (SB326).

In response, Equity Access Group (EAG) is stepping in with jumbo reverse mortgage solutions that provide seniors aged 55 and over a way to unlock their home equity, even if their HOA has yet to meet the updated SB326 requirements.

SB326 Compliance Delays Are Creating Financing Gaps for Seniors:

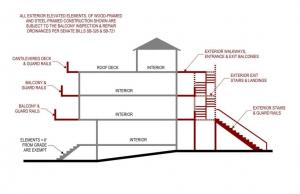

Originally enacted in 2019 following the Berkeley balcony collapse, Senate Bill 326 (SB326) requires all condominium homeowners associations (HOAs) with exterior elevated elements, such as balconies and walkways, to complete safety inspections by a licensed structural engineer every nine years.

Although the inspection deadline was recently extended from 2025 to January 1, 2026, many HOAs remain non-compliant due to funding shortages, limited access to qualified inspectors, and organizational delays.

While the law is designed to improve long-term resident safety, it has introduced short-term challenges. In the current lending environment, many traditional lenders are now declining applications for reverse mortgages in non-compliant buildings, even when borrowers are financially qualified.

Due to issues beyond their control, the legislation has left older homeowners unable to access their equity or eliminate monthly mortgage payments.

EAG’s Solution: Flexible Reverse Mortgages for a Shifting Condo Market:-

Equity Access Group is responding with customizable jumbo reverse mortgage products that are not limited by FHA property criteria. These loans are funded through private capital, allowing for more flexible risk assessments and underwriting, particularly useful in cases where the HOA is working toward, but has not yet achieved, SB326 compliance.

EAG reverse mortgage programs allow qualified homeowners to:

1. Eliminate monthly mortgage payments

2. Convert equity into tax-free funds

3. Remain in their homes during HOA inspection delays

4. Cover living costs, healthcare expenses, or special assessments

“We fully support the goal of safer housing,” said Jason, CMO at EAG. “But seniors shouldn’t lose access to their equity while their HOA works through inspections. We offer a way forward when others can’t.”

A Delayed Market, But a Clear Need:

Recent reporting from Ad Magellan and HOA industry sources suggests that buildings lagging in SB326 compliance are already experiencing:

1. Declined loan applications

2. Higher insurance premiums

3. Stalled property listings and sales

These disruptions are especially difficult for older homeowners with limited income streams or time-sensitive financial needs. Equity Access Group’s tailored approach helps borrowers overcome these barriers without having to move, delay retirement, or rely on expensive short-term financing.

“We look at the full picture, not just the HOA report,” Jason added. “Our mission is to give seniors access to what they’ve earned: the ability to retire on their terms, in the homes they love.”

For older condo owners facing stalled financing or sale options due to SB326, EAG provides lending clarity and security, even when the market doesn’t.

About Equity Access Group

Equity Access Group is a leading provider of reverse mortgage solutions, offering both government-insured HECMs and private jumbo reverse mortgages. With a commitment to personalized service and senior-focused financial education, EAG helps homeowners unlock the full value of their equity to support a secure and independent retirement.

Jason Nichols

Truss Financial Group

+1 888-391-4324

email us here

Visit us on social media:

Facebook

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Culture, Society & Lifestyle, Insurance Industry, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release