Takaful Insurance Market is likely to expand US$ 111.89 billion at 9.41% CAGR by 2034

Takaful Insurance Market Growth

Takaful Insurance Market Research Report By, Coverage Type, Distribution Channel, Purpose, Customer Type, Product Type, Regional

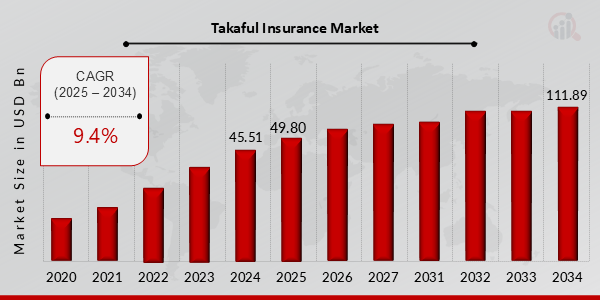

TN, UNITED STATES, March 12, 2025 /EINPresswire.com/ -- The Takaful Insurance Market has experienced steady growth in recent years and is projected to expand significantly over the coming decade. In 2024, the market size was estimated at USD 45.51 billion, and it is expected to grow from USD 49.79 billion in 2025 to an impressive USD 111.89 billion by 2034, reflecting a compound annual growth rate (CAGR) of 9.41% during the forecast period (2025–2034). The market's expansion is primarily driven by the increasing awareness of Islamic insurance principles, the growing demand for ethical financial products, and the expansion of the global Muslim population.

Key Drivers of Market Growth

1. Increasing Demand for Sharia-Compliant Financial Products

The rising preference for ethical and interest-free financial solutions is fueling the demand for Takaful insurance among individuals and businesses adhering to Islamic finance principles.

2. Growth of the Islamic Banking & Finance Sector

The expansion of Islamic banking worldwide is positively influencing the Takaful market, as these financial institutions promote and integrate Takaful products into their offerings.

3. Government Support & Regulatory Advancements

Many governments in Muslim-majority countries are implementing favorable policies and regulatory frameworks to support the growth of Takaful insurance, fostering a stable and transparent market environment.

4. Rising Awareness & Adoption in Non-Muslim Regions

Takaful is gaining traction beyond traditional markets as non-Muslim consumers and businesses seek ethical insurance alternatives, driving international market expansion.

5. Technological Advancements & Digital Transformation

Insurtech innovations, digital distribution channels, and AI-driven underwriting are enhancing the efficiency and accessibility of Takaful insurance, making it more attractive to a broader audience.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/22709

Key Companies in the Takaful Insurance Market Include:

• Takaful Emarat Insurance Company

• Hong Leong Assurance

• Ethica Takaful Insurance

• SALAMA Cooperative Insurance Company

• Tokio Marine Life Insurance Malaysia

• Solidarity Takaful Sudan

• AlRajhi Takaful

• Allianz Malaysia Berhad

• Zurich Takaful Malaysia Berhad

• Oman Insurance Company

• Al Hilal Takaful

• AXA Affin General Takaful

Browse In-Depth Market Research Report – https://www.marketresearchfuture.com/reports/takaful-insurance-market-22709

Market Segmentation

To provide a comprehensive analysis, the Takaful Insurance Market is segmented based on type, distribution channel, end-user, and region.

1. By Type

• Family Takaful: Covers life insurance and health-related benefits.

• General Takaful: Includes motor, property, liability, and marine insurance.

• Medical Takaful: Offers health insurance solutions aligned with Islamic finance principles.

2. By Distribution Channel

• Agents & Brokers: Traditional sales channels offering personalized services.

• Banks (Bancatakaful): Takaful products distributed through Islamic banks.

• Direct & Online Channels: Growing digital adoption and insurtech-driven platforms.

3. By End-User

• Individuals: Personal insurance solutions for health, life, and vehicle coverage.

• Corporates & SMEs: Business-focused Takaful products for risk management.

• Government & Public Institutions: Public sector entities utilizing Takaful for employee benefits and infrastructure protection.

4. By Region

• Middle East & Africa: Leading market driven by high adoption in GCC countries.

• Asia-Pacific: Fastest-growing region, with Malaysia, Indonesia, and Pakistan as key markets.

• Europe: Growing demand for ethical insurance solutions among diverse populations.

• Rest of the World (RoW): Increasing awareness and adoption in emerging economies.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=22709

The global Takaful Insurance Market is set for substantial growth, driven by the demand for ethical financial services, favorable regulatory frameworks, and technological advancements. As awareness of Takaful continues to rise, the industry will witness increased adoption, innovation, and expansion into new markets, positioning Takaful as a mainstream insurance alternative in the global financial ecosystem.

Related Report –

Real Estate Investment Trust Market

Agricultural Crop Insurance Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release