Open Banking Market Promoting Innovation and Competition With Revenue By USD 204 billion by 2033

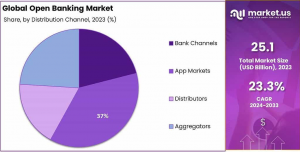

Moreover, the App Markets segment also demonstrated a significant hold on the market with over a 37% share in 2023...

NEW YORK, NY, UNITED STATES, February 19, 2025 /EINPresswire.com/ -- The Open Banking market is currently experiencing dynamic growth, forecasted to expand from USD 25 billion in 2023 to USD 204 billion by 2033. This substantial increase at a compound annual growth rate (CAGR) of 23.3% emphasizes the technological and regulatory shifts impacting traditional banking systems.

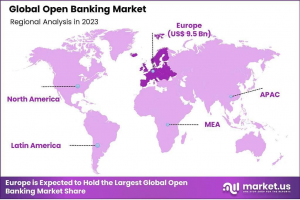

Open Banking allows third-party providers to access consumer financial data via APIs, promoting innovation and competition. Particularly in Europe, which held a 38% market share in 2023, digital transformation strategies have led to widespread adoption, driven by both consumer demand for personalized services and regulatory mandates encouraging financial transparency.

🔴 𝐃𝐢𝐫𝐞𝐜𝐭 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/open-banking-market/free-sample/

Emerging technological trends such as AI and machine learning further support this expansion by offering more sophisticated financial products and services. As traditional banks and fintech firms collaborate, they innovate and cater to a growing digitally-savvy customer base, propelling Open Banking forward globally.

Key Takeaways

The Global Open Banking Market is on a trajectory to grow significantly, projected to expand from USD 25 Billion in 2023 to an impressive USD 204 Billion by 2033. This growth represents a robust compound annual growth rate (CAGR) of 23.3% during the forecast period from 2024 to 2033.

In 2023, Europe emerged as a powerhouse in the Open Banking landscape, commanding a 38% market share with revenues reaching USD 9.5 Billion. This dominance is attributed to the progressive regulatory frameworks and strong adoption of digital banking solutions across the region, fostering a favorable environment for Open Banking practices.

Focusing on specific segments within the Open Banking Market, the Banking and Capital Markets segment was particularly prominent in 2023, seizing more than a 44% share. This segment benefits from the deep integration of open APIs that allow third-party developers to build applications and services around the financial institution, enhancing customer experience and offering tailored financial solutions.

Moreover, the App Markets segment also demonstrated a significant hold on the market with over a 37% share in 2023. This segment thrives as financial institutions and fintech companies increasingly rely on applications to offer enhanced accessibility and personalized services to users, thereby driving the adoption of open banking platforms.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=110461

Experts Review

Government Incentives and Technological Innovations: Government regulations like the EU's PSD2 are central to fostering Open Banking, ensuring secure data sharing and innovation. Emerging technologies, particularly AI and big data, drive this growth by enhancing financial service capabilities.

Investment Opportunities & Risks: The rapid growth opens attractive investment avenues, yet it carries risks, chiefly around data security. Investors must navigate these risks to leverage Open Banking’s potential fully.

Consumer Awareness and Technological Impact: Consumer awareness is increasing, with more users adopting financial technologies driven by Open Banking. Technological innovations deliver tailored financial services, greatly impacting user experience and satisfaction.

Regulatory Environment: The regulatory environment is supportive but complex. Navigating compliance while innovating presents challenges but is necessary for fostering a competitive market environment.

🔴 𝐓𝐨 𝐆𝐚𝐢𝐧 𝐠𝐫𝐞𝐚𝐭𝐞𝐫 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/open-banking-market/free-sample/

Report Segmentation

The Open Banking market is stratified into various segments to address diverse consumer and business needs comprehensively. Key services include Banking and Capital Markets, Payments, Digital Currencies, and Value-Added Services. Within distribution channels, the market utilizes Bank Channels, App Markets, Distributors, and Aggregators. Each segment addresses unique consumer needs—Banking and Capital Markets focus on seamless integration, while App Markets cater to mobile-oriented consumers demanding convenience and real-time data.

Payments and Digital Currencies drive innovation in transaction processing, and Value-Added Services offer customized financial solutions. Together, these segments provide a robust ecosystem supporting financial innovation and market expansion, demonstrating the growing aptitude of Open Banking to adapt to evolving financial landscapes and consumer behaviors.

Key Market Segments

By Services

Banking & Capital Markets

Payments

Digital Currencies

Value Added Services

By Distribution Channel

Bank Channels

App Markets

Distributors

Aggregators

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://market.us/purchase-report/?report_id=110461

Drivers, Restraints, Challenges, and Opportunities

Drivers: Integration of AI and big data enhances Open Banking by allowing personalized, efficient services. Such technologies are pivotal in attracting consumers by offering improved security and service customization.

Restraints: Data security remains a significant concern, with risks of breaches and cyberattacks. Regulatory compliance complexities can deter consumer adoption due to privacy concerns.

Challenges: Balancing innovation with regulatory compliance limits the speed of new developments. Ensuring safe data handling while fostering innovation is a critical challenge.

Opportunities: Regulatory frameworks fostering competition and innovation create new market opportunities. Supportive regulations and technological advancements encourage new tools and services, enhancing Open Banking's market presence.

Key Player Analysis

The Open Banking market is shaped by major financial entities and innovative fintechs like Tink, Societe Generale, and Nordigen. Tink stands out for its acquisitions, notably Instantor, enhancing its analytics capabilities. Societe Generale is leveraging partnerships to expand its digital banking suite. Nordigen specializes in providing free banking data analytics, and empowering service providers with influential financial insights. These key players are instrumental in driving Open Banking's evolution by continuously innovating and expanding service offerings to meet evolving consumer expectations.

Top 10 Biggest Key Players

Tink

Societe Generale

Nordigen Solutions

Deposit Solutions

Yapily Ltd.

Jack Henry & Associates Inc.

Credit Agricole

Finestra

BBVA SA

Revolut Ltd.

Other Key Players

Recent Developments

Recent industry advancements underscore Open Banking’s expanding role in financial services. In 2023, BNY Mellon introduced Bankify, a solution leveraging open banking for guaranteed payment receivables, enhancing operational efficiency. Meanwhile, Payer Financial Services AB launched a payments system in Sweden, using APIs to streamline business transactions, ensuring transparency and trust. Such developments indicate robust activity, highlighting Open Banking's adaptability and growing presence in financial technology.

Conclusion

The Open Banking market is poised for remarkable growth, driven by technological innovations, regulatory support, and enhanced consumer engagement. While data security remains a challenge, the collaboration between traditional banks and fintech firms ensures innovative, efficient, and secure financial services, paving the way for sustained market evolution and expansion.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

Automotive Predictive Maintenance Market - https://market.us/report/automotive-predictive-maintenance-market/

3D Printed Wearables Market - https://market.us/report/3d-printed-wearables-market/

On-Demand Transportation Market - https://market.us/report/on-demand-transportation-market/

Location-Based Advertising (LBA) Market - https://market.us/report/location-based-advertising-lba-market/

Content Analytics Market - https://market.us/report/content-analytics-market/

Ingestible Sensors Market - https://market.us/report/ingestible-sensor-market/

Pressure Sensors Market - https://market.us/report/pressure-sensors-market/

3D Projector Market - https://market.us/report/3d-projector-market/

AI Video Generator Market - https://market.us/report/ai-video-generator-market/

Podcast Advertising Market - https://market.us/report/podcast-advertising-market/

Catalog Management System Market - https://market.us/report/catalog-management-systems-market/

AI Voice Generator Market - https://market.us/report/ai-voice-generator-market/

Disaster Recovery Solutions Market - https://market.us/report/disaster-recovery-solutions-market/

3D Gaming Console Market - https://market.us/report/3d-gaming-console-market/

Conversational Systems Market - https://market.us/report/conversational-systems-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release