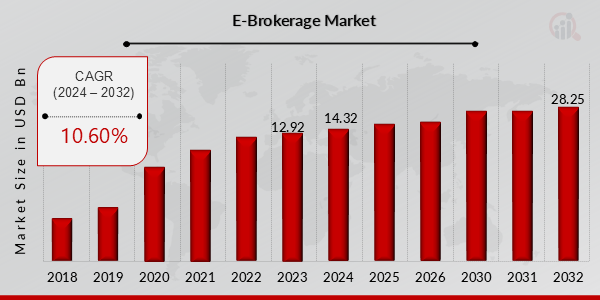

E-Brokerage Market Size to Hit 28.25 billion by 2032 at 10.60% CAGR

E-Brokerage Market Trends

E-Brokerage Market Research Report By, Trading Platform, Investment Type, Client Type, Technology, Regulation, Regional

SD, UNITED STATES, February 19, 2025 /EINPresswire.com/ -- The global E-Brokerage Market has witnessed significant growth in recent years and is poised for substantial expansion over the coming decade. In 2023, the market size was estimated at USD 12.92 billion and is projected to grow from USD 14.32 billion in 2024 to an impressive USD 28.25 billion by 2032, reflecting a strong compound annual growth rate (CAGR) of 10.60% during the forecast period (2024–2032). The market’s growth is primarily driven by the rising adoption of digital trading platforms, increasing retail investor participation, and advancements in trading technology.

Key Drivers of Market Growth

Rising Adoption of Digital Trading Platforms

The shift towards online brokerage services has revolutionized the trading industry. Retail and institutional investors are increasingly using e-brokerage platforms due to their convenience, lower transaction costs, and real-time access to global markets.

Growing Retail Investor Participation

The democratization of stock market access has led to a surge in retail trading activities. Factors such as commission-free trading, fractional share investing, and the rise of financial literacy among young investors are driving e-brokerage market growth.

Technological Advancements in Trading

The integration of artificial intelligence (AI), machine learning (ML), and blockchain technology is enhancing trading efficiency, risk management, and fraud detection. AI-powered robo-advisors and algorithmic trading have also contributed to market expansion.

Increased Mobile Trading and App-Based Platforms

The widespread use of smartphones has accelerated the adoption of mobile trading apps. Platforms offering user-friendly interfaces, real-time analytics, and personalized recommendations are attracting more users to digital brokerage services.

Regulatory Developments and Market Transparency

Regulatory bodies worldwide are implementing policies to enhance transparency and security in digital trading. Investor protection laws, data privacy regulations, and stricter compliance requirements are strengthening market confidence.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/24420

Key Companies in the E-Brokerage Market Include:

• Merrill Edge (Bank of America)

• Charles Schwab

• M1 Finance.

• Fidelity Investments

• SoFi Invest

• TD Ameritrade

• Interactive Brokers

• Robinhood

• P. Morgan

• ETrade

• Wells Fargo Advisors

• Ally Invest

• Vanguard

• Webull Financial

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/e-brokerage-market-24420

Market Segmentation

To provide a comprehensive analysis, the E-Brokerage Market is segmented based on type, trading platform, end-user, and region.

1. By Type

• Equities Brokerage: Trading services for stocks and ETFs.

• Derivatives Brokerage: Options, futures, and other financial instruments.

• Forex Brokerage: Foreign exchange trading platforms.

• Cryptocurrency Brokerage: Increasing demand for digital asset trading services.

2. By Trading Platform

• Web-Based Trading: Desktop platforms offering advanced trading tools.

• Mobile-Based Trading: Growing dominance of app-based trading services.

• Hybrid Platforms: Combining web and mobile trading functionalities.

3. By End-User

• Retail Investors: Individual traders utilizing self-directed brokerage accounts.

• Institutional Investors: Hedge funds, mutual funds, and financial institutions leveraging e-brokerage services.

4. By Region

• North America: Leading market driven by high retail trading activity and technological advancements.

• Europe: Strong growth due to increasing adoption of online trading and regulatory compliance.

• Asia-Pacific: Fastest-growing region fueled by rising fintech adoption in China, India, and Japan.

• Rest of the World (RoW): Emerging markets in Latin America, the Middle East, and Africa showing potential for e-brokerage growth.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24420

The global E-Brokerage Market is set to experience significant transformation, driven by digitalization, technological advancements, and increasing investor engagement. As AI-driven trading tools, commission-free models, and crypto integration continue to evolve, e-brokerage platforms will play a pivotal role in shaping the future of digital investing. With expanding global access to financial markets, the industry is expected to witness sustained growth and innovation.

Related Report –

Trade Finance Market

https://www.marketresearchfuture.com/reports/trade-finance-market-24698

Home Mortgage Finance Market

https://www.marketresearchfuture.com/reports/home-mortgage-finance-market-24607

Mortgage Loan Brokers Market

https://www.marketresearchfuture.com/reports/mortgage-loan-brokers-market-24638

Banking ERP Software Market

https://www.marketresearchfuture.com/reports/banking-erp-software-market-24836

Anti Money Laundering Solutions Market

https://www.marketresearchfuture.com/reports/anti-money-laundering-solutions-market-24771

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release