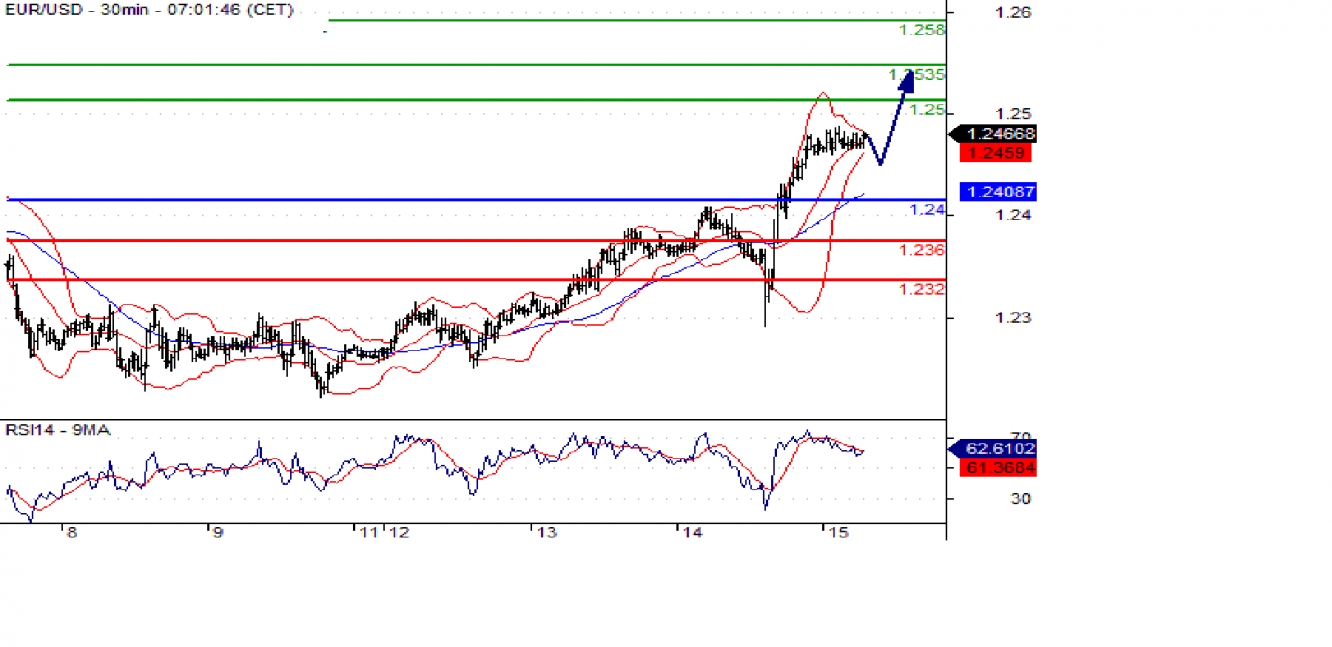

EUR/USD Intraday: the bias remains bullish.

pivot: 1.2400

Our preference: long positions above 1.2400 with targets at 1.2500 & 1.2535 in extension.

Alternative scenario: below 1.2400 look for further downside with 1.2360 & 1.2320 as targets.

Comment: the RSI is bullish and calls for further upside.

Supports and resistances:

1.2580 1.2535 1.2500

1.2440 Last seen

1.2400 1.2360 1.2320

GBP/USD Intraday: the bias remains bullish.

Pivot: 1.3920

Our preference: long positions above 1.3920 with targets at 1.4050 & 1.4105 in extension.

Alternative scenario: below 1.3920 look for further downside with 1.3875 & 1.3830 as targets.

Comment: the RSI advocates for further upside.

Supports and resistances:

1.4170 1.4105 1.4050

1.3980 Last seen

1.3920 1.3875 1.3830

USD/JPY Intraday: capped by a negative trend line.

Pivot: 107.20

Our preference: short positions below 107.20 with targets at 106.15 & 105.70 in extension.

Alternative scenario: above 107.20 look for further upside with 107.90 & 108.50 as targets.

Comment: the RSI is capped by a bearish trend line.

Supports and resistances:

108.50 107.90 107.20

106.65 Last seen

106.15 105.70 105.00

USD/CAD Intraday: the downside prevails.

Pivot: 1.2560

Our preference: short positions below 1.2560 with targets at 1.2455 & 1.2430 in extension.

Alternative scenario: above 1.2560 look for further upside with 1.2590 & 1.2620 as targets.

Comment: the RSI shows downside momentum.

Supports and resistances:

1.2620 1.2590 1.2560

1.2515 Last seen

1.2455 1.2430 1.2400

NZD/USD Intraday: the upside prevails.

Pivot: 0.7335

Our preference: long positions above 0.7335 with targets at 0.7415 & 0.7450 in extension.

Alternative scenario: below 0.7335 look for further downside with 0.7300 & 0.7265 as targets.

Comment: the RSI shows upside momentum.

Supports and resistances:

0.7485 0.7450 0.7415

0.7380 Last seen

0.7335 0.7300 0.7265

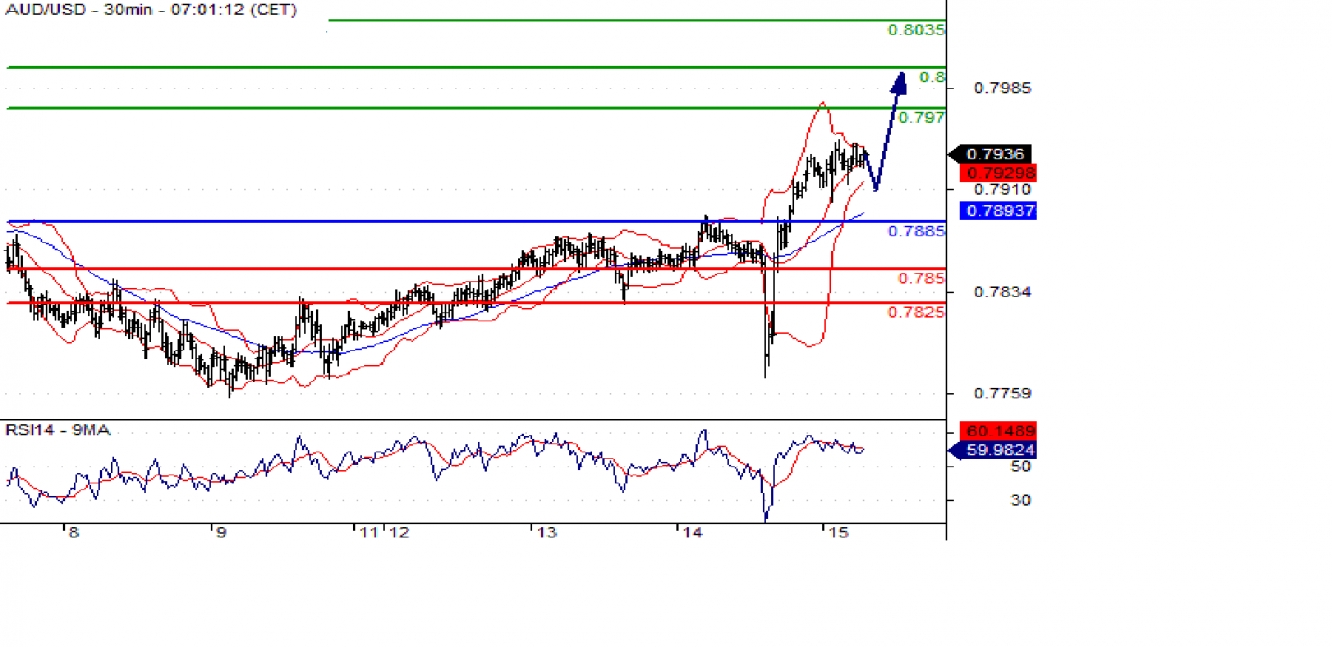

AUD/USD Intraday: the upside prevails.

Pivot: 0.7885

Our preference: long positions above 0.7885 with targets at 0.7970 & 0.8000 in extension.

Alternative scenario: below 0.7885 look for further downside with 0.7850 & 0.7825 as targets.

Comment: the RSI shows upside momentum.

Supports and resistances:

0.8035 0.8000 0.7970

0.7925 Last seen

0.7885 0.7850 0.7825

Gold Spot Intraday: the upside prevails.

Pivot: 1341.00

Our preference: long positions above 1341.00 with targets at 1360.50 & 1366.00 in extension.

Alternative scenario: below 1341.00 look for further downside with 1336.00 & 1330.00 as targets.

Comment: the RSI is bullish and calls for further advance.

Supports and resistances:

1378.50 1366.00 1360.50

1354.66 Last seen

1341.00 1336.00 1330.00

Crude Oil (WTI) (H18) Intraday: further upside.

Pivot: 60.60

Our preference: long positions above 60.60 with targets at 62.05 & 62.60 in extension.

Alternative scenario: below 60.60 look for further downside with 59.85 & 59.30 as targets.

Comment: the RSI advocates for further advance. The price broke above a declining trend line. The 20-period moving average crossed above the 50-period one.

Supports and resistances:

63.20 62.60 62.05

61.32 Last seen

60.60 59.85 59.30