Up, Up, Down, Down: Gold on the March to all time highs with US$3100 in the rear view

Nothing can stop the advance of the gold price, it seems, with bullion sailing past US$3100/oz in March as other commodities whimpered.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Milestone levels of over US$3000/oz are already in the rear view for gold, with even US$4000/oz now being considered by analysts

Red metal follows yellow higher as Trump tariffs stir US copper arbitrage

Coal rebounds as iron ore, lithium slip up

WINNERS

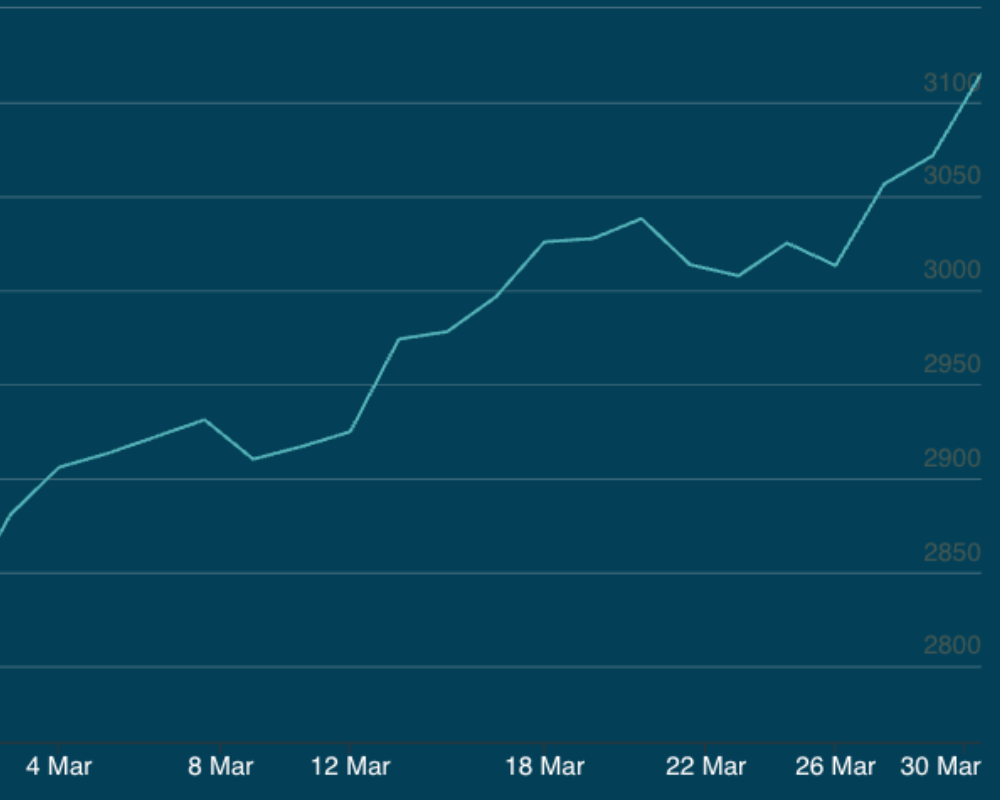

Gold

Price: US$3115.10/oz

% Change: +9.9%

Don't get bored hearing about gold because bullion set multiple fresh highs in the month of March, all leading to the imposition of Donald Trump's 'reciprocal tariffs' on April 2.

Concerns around the state of the US and global economy have ratcheted up with markets in the dark on the long term impact of the protectionist gamble.

In the dark gold has shone, hitting the remarkable level of $5000/oz Australian on Monday.

At these levels, there remains upside for ASX gold miners, with consensus pricing in EV/EBITDA multiples below three year averages next financial year.

"Despite improved earnings confidence, FY26E EV/EBITDA consensus for producers is ~25% below 3-year averages, with mid-tiers ~40% below," RBC's Alex Barkley said in a note. "Given improving earnings and balance sheets we generally favour perceived 'lower quality' mid-tiers, ideally with relatively unhedged production."

Analysts are starting to look for upside lower in the food chain as prices encourage a new generation of Australian gold producers to emerge. Both Canaccord Genuity and Morgans initiated on Medallion Metals (ASX:MM8), owner of the Ravensthorpe gold project, this week with respective 55c and 41c price targets, while RBC initiated on NZ explorer Santana Minerals (ASX:SMI) with a 75c price target.

Silver prices also lifted through the quarter, but in the grand scheme of things an attempt at a "Silver Squeeze 2.0" on Monday looks to have drawn a blank. Analysts remain bullish on the precious-cum-industrial metal, but we wrote here why investors should be cautious of coordinated short squeezes.

UP

- Investment banks, brokers and more are dramatically scaling up gold price forecasts, with many now tipping scenarios ranging up to US$3500/oz this year.

- Argonaut sees US$4000/oz by 2027 as a possibility, lifting its gold forecasts by 20-50% over the next five years this week.

DOWN

- RBC warns too much of the upside priced into gold could be from market uncertainty, with long-term macro fundamentals suggesting gold could reasonably be priced around US$800/oz lower than it is today. ANZ's FX Bubble Indicator suggests there is a bubble risk of a short term pullback in gold, though the bank has recently upped its six month forecast to US$3200/oz.

- There remains downside risk with individual gold miners. Not every post can be a winner even in a market like this one. Bellevue Gold's impending second production downgrade this quarter is a case in point.

READ

Bad vibes good for gold as banks scramble to keep up with the flying metal

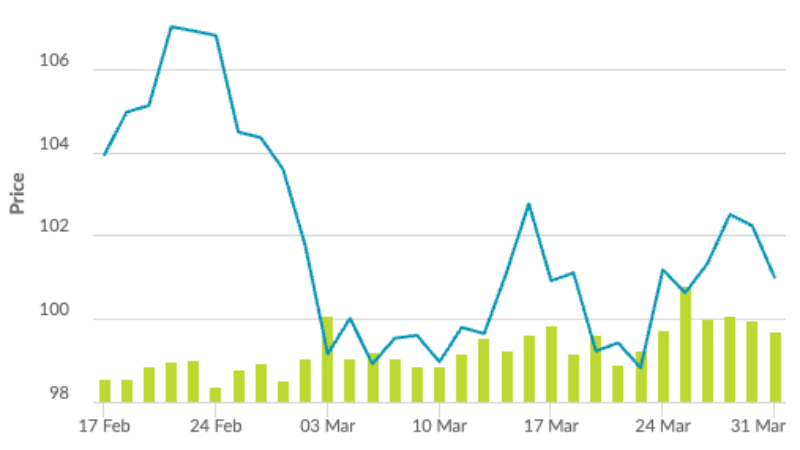

Coal (Newcastle 6000 kcal)

Price: US$103.45/t

% Change: +4.5%

Coal's crummy year got a little brighter last week as Glencore cut 10Mt of output from its Cerrejon mine in Colombia in response to a price drop, putting a floor under the energy commodity.

Prices had sunk as low as US$95/t before the act of supply discipline came in, with a number of thermal and met coal producers under water at current levels.

Coking coal, which sunk into the US$160s, is also back up around US$175/t.

UP

- Argonaut's Jon Scholz estimated around a quarter of the metallurgical coal market was loss making at benchmark premium hard coking coal prices of US$180/t. That suggests supply cuts will be on the cards to support prices.

- Whitehaven Coal completed its cash spinning selldown of a 30% stake in the Blackwater mine to Japanese steelmakers for US$1.08bn, demonstrating the long-term offtake interest in coking coal from customers.

DOWN

- Coal markets remain well supplied, with cheap Russian coal keeping a lid on prices.

- First quarter purchases of seaborne coal from China, India, Japan and South Korea fell 10% against the same period in 2024 according to Reuters, with higher clean power generation like hydro and domestic coal production impacting demand for imports.

READ

Bulk Buys: If these budget forecasts are correct I'll eat this hat

Rare Earths (NdPr Oxide)

Price: US$61.10/kg

% Change: +0.63%

Rare earths settled after a promising February, when a sharp price was largely fuelled by speculation that proposed Chinese regulations could force the rare earths industry to consolidate and trim production.

A slight uptick in prices at the end of the month came as an earthquake throttled Myanmar, killing more than 2000 people and devastating the city of Mandalay. But Shanghai Metals Market analysts reported that the country's mines, largely near its border with China, were not impacted by the tragedy.

Most reporting from the coal face suggests downstream companies continue to be loathe to accept markedly higher prices for raw materials amid rough domestic economic conditions.

UP

- China announced plans to 'vigorously boost consumption' in the days following the Two Sessions meetings in Beijing last month. That's got flow on impacts for rare earths. While magnets made with rare earth metals like neodymium, praseodymium, dysprosium and terbium are lauded for their use in electric vehicles, defence and wind turbines, a large portion of demand comes from consumer electronics like aircons.

- Aussie clay hosted rare earths hopefuls are staking a claim to become suppliers of heavy rare earths outside of China, with Victory Metals (ASX:VTM) delivering a scoping study on its North Stanmore project, placing a $1.2bn NPV on the terbium and dysprosium rich asset in March.

DOWN

- The State Government of Kachin has given the go ahead for the export of rare earth ores into China, which have been stockpiled since a rebel takeover of the border region in October. That could bring withheld supply into the market, with Myanmar responsible for ~70% of China's rare earth ore imports last year according to the Shanghai Metals Market.

- The Australian Government's attempts to broker access to our critical minerals in exchange for tariff exemptions from the Trump Administration came a cropper. In reality there's already a major Australian manufacturing push in the States, with Gina Rinehart backed Lynas (ASX:LYC) funded by the Department of Defense to construct light and heavy rare earths separation facilities in Texas.

READ

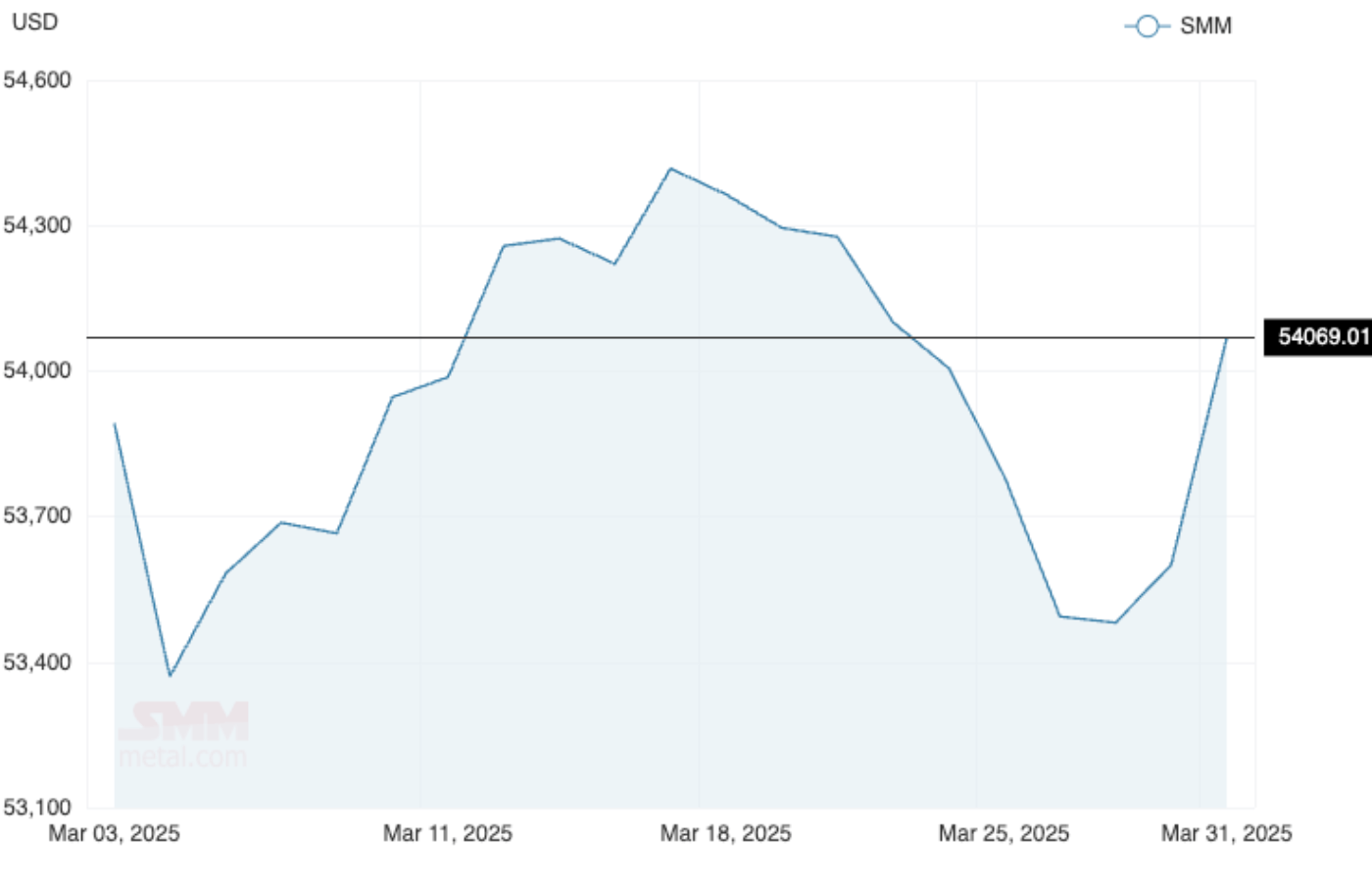

Copper

Price: US$9710/t

% Change: +3.76%

Copper prices have been a jumble in March, hitting records in some markets while others bubbled under the surface.

The big arbitrage has come in the US, where Comex futures have scaled levels beyond US$5/lb for the second time in a year, powered by concerns an investigation will lead to tariffs being placed on copper imports into the US.

They could come sooner rather than later, according to ING commodities strategist Ewa Manthey.

"Reportedly, the administration is proceeding expeditiously with the review, and a conclusion could be possible well before the 270-day deadline," she said in a note last week.

"Copper on New York’s Comex rose to a record high,driven by tariffs fears, while the benchmark LME prices dropped following the news as expectations for the ex-US tightness are now retreating.

"This had widened the gap between the Comex and LME contracts to more than $1700/t."

UP

- The copper market was in a 19,000t apparent deficit in January, according to the International Copper Study Group. That compares to a 24,000t deficit at the same time last year, and clocks in at 17,000t when adjusted for estimated changes in Chinese bonded stocks.

- While there are fears Trump tariffs could tank global trade, hurting prices of economic monitor commodities like copper, so far the import-export arbitrage has been a stronger driver of prices, pushing them higher.

DOWN

- First Quantum Minerals has dropped a US$20bn arbitration claim against the Panamanian Government for its forced suspension of the Cobre Panama mine. That's raised hopes a solution will be found to return the mine, responsible for ~1.5% of global copper supply back to production. Cobre Panama's suspension had been responsible for a sharp spike in copper prices in early 2024 as its closure left a previously oversupplied market short of concentrate.

- Copper supply growth, at least of concentrates, is rising faster than apparent copper usage, with mine production up 2% in January, largely due to higher output in Peru (+7% YoY), DRC (+6%) and Asia (+3%). North America and Chile disappointed, the latter down 2.7%. Chinese, and world, "apparent" demand rose 1%.

READ

Barry FitzGerald: Copper prices are confusing right now but that's creating value in small caps

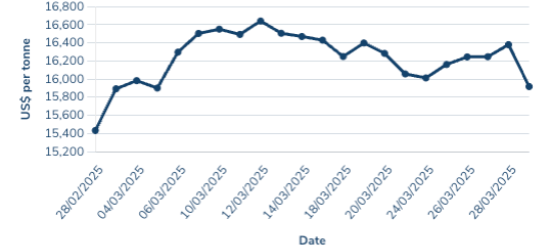

Nickel

Price: US$15,918/t

% Change: +3.14%

Nickel's flotsam and jetsam between US$15,000/t and US$16,000/t continued as believers continue to pray for light at the end of a long and dark tunnel.

The itchy fingers of the Indonesian Government may help them, with the country that tanked the nickel price now eager to see better returns for the pro-development ideology it propagated for a decade.

While one side of Indonesia's (Chinese supported) nickel boom was a result of nationalistic policies to onshore refining, as well as subsidised domestic coal supply, another component was a policy of tax holidays for refiners.

The latest moves to generate more income from the industry come not against refineries but miners, with royalties on nickel ore mining potential lifting from a flat 10% to 14-19% depending on prices.

Progressive rates have also been proposed for nickel matte and nickel pig iron.

ASX listed Nickel Industries (ASX:NIC) said only its ore sales from the Hengjaya mine would be impacted by proposed policy changes, not its RKEF lines, which comprise the bulk of its earnings and procure ore externally.

We're already well into the cost curve, including in Indonesia, so it will be interesting to see how this policy shift impacts supply.

UP

- The aforementioned tax policy and reduced RKAB (mining) permits in Indonesia shows the "OPEC of nickel" could be starting to take its role to support prices for the battery metal and stainless steel ingredient more seriously.

- Short term impacts have been seen, with nickel ore prices within Indonesia lifting 6.8% on Friday.

DOWN

- The LME copped a £9.2m ($19m) fine from Britain's Financial Conduct Authority for mismanaging a nickel squeeze that saw prices surge over US$100,000/t briefly in March 2022 before the exchange shut the market to regain control for eight days. The LME accepted the FCA's findings.

- Fastmarkets says the closure of the Gunbuster smelter in Indonesia is unlikely to have an impact on the country's overall output, limiting price impacts from the failure of the Chinese backed refinery.

READ

Lunch Wrap: ASX dips on global sell-off; Nickel Industries plunges 21pc as Indonesia eyes tax hike

LOSERS

Iron ore (SGX Futures)

Price: US$100.99/t

% Change: -2.19%

Iron ore prices remain stubbornly high, reflected in the updated expectations of the Department of Industry, Science and Resources, which has projected higher earnings over the next two years from Australia's key export.

There months on from its December quarter projections, the Office of the Chief Economist has made some positive near term changes for both 2024-25 and 2025-26 in this week's March edition of the Resources and Energy Quarterly.

Earnings from iron ore exports are expected to lift from $108bn to $117bn this financial year and $93bn to $109bn next.

Those remain down from the $141bn raked in during 2023-24.

Iron ore continues to threaten a break below US$100/t, but high costs for marginal operators continue to put a floor under prices, even with China's steel sector in a financial hole.

UP

- A wave of M&A in the Pilbara has shown the majors remain positive on the long term future of their iron ore empires.

- The latest is a bid from Rio Tinto (ASX:RIO) majority owned Robe River JV, interloping in a three cornered contest to acquire Mark Creasy and his company CZR Resources' (ASX:CZR) Robe Mesa deposit against Fenix Resources (ASX:FEX) and

DOWN

- The initial boost from the National People's Congress in China simmered down over the month as major stimulus for the world's biggest steelmaker remains elusive.

- 55% of iron ore industry participants recently surveyed by Chinese consultancy MySteel expect prices to fall in April. That compared to just 28% who expected them to rise. Then again, if you're a contrarian ...

READ

Akora builds momentum as pre-feasibility study on African iron ore mine looms

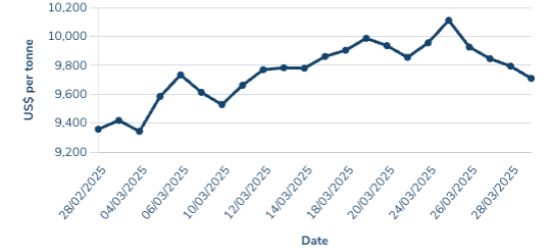

Lithium (Fastmarkets Carbonate CIF China, Japan and Korea)

Price: US$9350/t

% Change: -4.1%

Will we ever get out of this purgatory?

Lithium prices continue to sit at mild levels, with losses likely to persist among producers tied into big capital programs in WA.

As long as this situation continues, the assumption is that supply must come out of the market somewhere, but where?

Analysts are divided on when the market will return to surplus, with Canaccord Genuity last month trimming price targets for 6% Li2O spodumene concentrate (the product produced in WA mines) for 2026 by 15% to US$850/t, 2027 down 37% to US$900/t, and 2028 and 2029 off 35% and 25% respectively to US$1100/t and US$1500/t, the latter the long term price projection for the product. Balance is only expected to arrive by 2026.

Argonaut is more constructive, predicting a return to balance by the end of 2025 and suggesting a "more aggressive price rise" could occur for spodumene in 2026.

Fastmarkets says we'll see deficits fall from 154,000t in 2024 to 10,000t in 2025, ahead of a 1500t surplus next year. Here's hoping.

UP

- Analysts are ramping up demand forecasts for battery energy storage systems, expected to provide a second major growth limb for lithium demand alongside electric vehicles.

- China's BYD posted record revenue last month in a sign electric vehicle demand remains robust in certain markets.

DOWN

- A renewed push to develop a stalled pegmatite giant in the Democratic Republic of the Congo has emerged, with rumours circulating that both Kobold Metals, an exploration company funded in part by Bill Gates and Jeff Bezos, and Rio Tinto (ASX:RIO) have sought US Government help to broker a deal for the Roche Dure pegmatite. Its development has been tied up in a dispute between the delisted Australian explorer that drilled out the deposit, AVZ Minerals, and Chinese miner Zijin with a pinch of Congolese bureaucratic madness thrown in.

- US car sales rose overall last month, with BEVs taking a slightly larger 8.5% share of the market. But people are burning Teslas and 25% auto tariffs are about to hit, fuelling pessimism on the sector's growth in the United States.

READ

High Voltage: Battery storage could power the next lithium boom

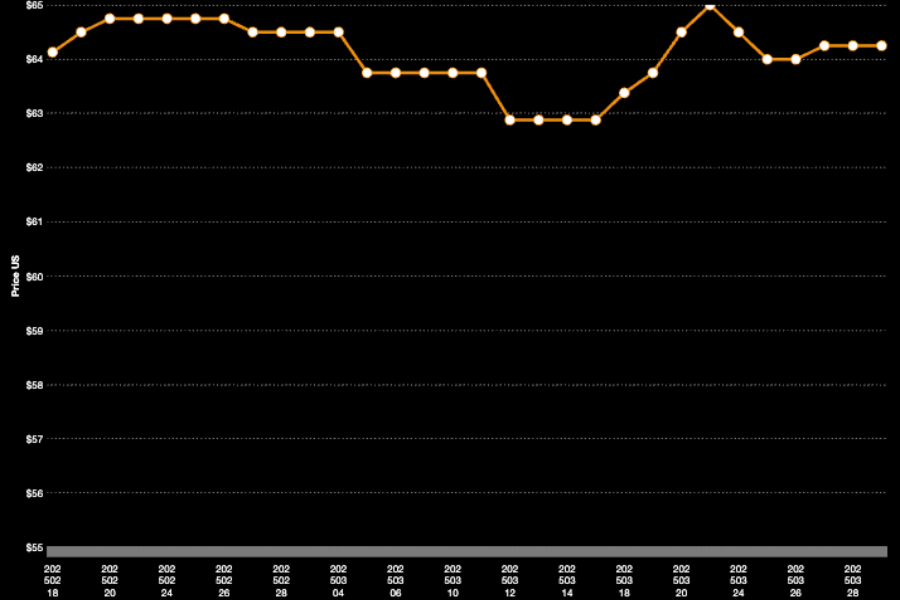

Uranium (Numerco)

Price: US$64.25/lb

% Change: -0.39%

Uranium has been hit hard by a slow down in contracting, in part influenced by confusion over tariffs that could be issued by the US Government on the nuclear fuel.

It is almost entirely reliant on product from overseas, with over a quarter coming from high grade mines in Canada, primarily Saskatchewan's Athabasca Basin.

Sprott says despite weak spot prices, the fundamentals remain solid for a long-term uranium bull market.

"While some utilities may choose to delay or defer new term contracts due to policy uncertainties, such caution can only last for so long. Eventually, utilities will need to secure sufficient fuel to meet operational demands, creating upward pressure on uranium prices once there is greater clarity in the operating environment," ETF product manager Jacob White said.

On the producer front it's been a tale of mixed fortunes. Paladin Energy (ASX:PDN) has suffered numerous analyst downgrades, but market watchers are more bullish on Boss Energy (ASX:BOE), with Euroz initiating on a buy rating and $4.50 price target in mid-March.

The owner of the Honeymoon uranium mine was trading at $2.30/sh on Wednesday.

UP

- Sprott's Jacob White says the lower contracting numbers seen last year (26% down from 161Mlb to 119Mlb) are misleading when it comes to reading utility demand, given the impact of large contracts (40% of last year's total came from a single customer in China, while a large Ukrainian order boosted 2023's breakout figure).

- Paladin Energy's troubles ramping up its Langer Heinrich mine in Namibia, exacerbated by extreme weather in recent weeks, shows how tough it is to bring new supply online quickly.

DOWN

- Uranium purchases in the United States have ground to a halt, Bloomberg reported, with a will they won't they tariffs dance on Canadian goods from the US Government killing market confidence among utilities.

- The Global X uranium miners ETF is down 18.23% over the past year.

READ

Monsters of Rock: Euroz goes bullish on uranium Boss, but Canaccord chops lithium price forecasts

OTHER METALS

Prices correct as of March 31, 2025.

Silver

Price: US$34.06/oz

%: +8.55%

Tin

Price: US$36,645/t

%: +17.03%

Zinc

Price: US$2852/t

%: +2.11%

Cobalt

Price: $US33,965/t

%:+41.61%

Aluminium

Price: $2533/t

%: -2.78%

Lead

Price: $2012/t

%: +0.98%

Graphite

Price: US$430/t

%: 0.00%

Originally published as Up, Up, Down, Down: Gold on the March to all time highs with US$3100 in the rear view

Trending now

‘We didn’t measure up’: THHS admits to ‘inadequate response’ after sexual assault of nurse

12 months on: City under a dark cloud with no end in sight to Thompson debacle

Bombshell email reveals reason for $5bn CopperString cost blowout

Landlords could be forced to install solar panels