MNI EUROPEAN MARKETS ANALYSIS: Oil Firms, Fresh Record High For Gold Despite Firmer USD Backdrop

- US cash Tsy curve is slightly steeper today with yields 1-3bps lower. Still, the USD has been supported on dips, consolidating strong gains for the week. The BBDXY just shy of week to date highs.

- Brent crude is firmer in the first part of Friday trade, amid on-going Middle East tensions as the weekend approaches. Gold set another record high. Hong Kong and China equity markets are lower today with tech names leading the decline. The BoK left rates on hold in South Korea, but gave a somewhat dovish outlook, which has weighed on KRW.

- Looking ahead, UK growth data headlines the calendar on Friday, before UMich consumer sentiment and inflation expectations will be the US focus.

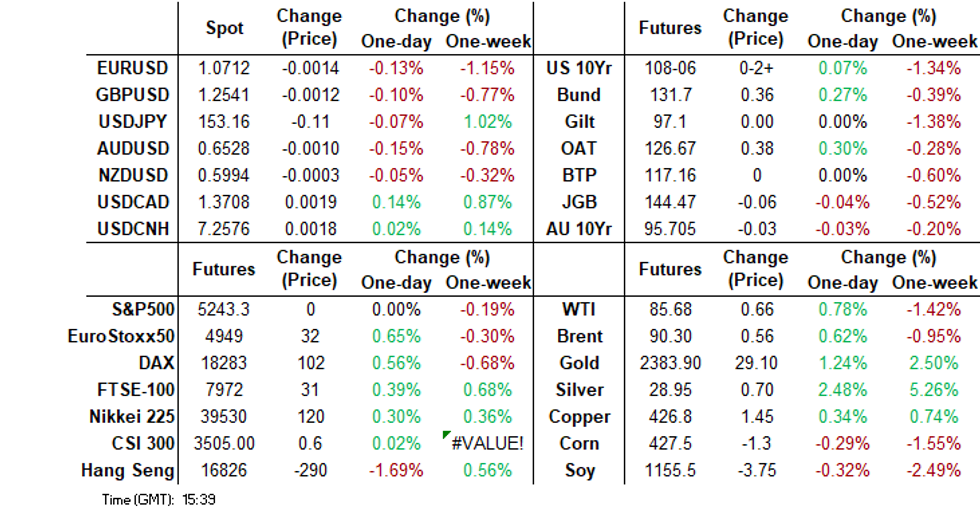

MARKETS

US TSYS: Treasury Futures Little Changed, Yields 1-2bps Lower, UofM Sentiment Later

- Jun'24 futures edged slightly higher in the morning session hitting highs of 108-07+, before paring most of those gains to trade up + 01 at 108-04+. 10Y futures have touched oversold territory, with the 14-day RSI now hovering at 30, levels we have not seen since Oct 2023 when the 10y yield hit 5%, while 5Y futures are now trading below the 30 mark.

- Looking at technical levels: Initial support lays at 108-00 (round number support), below here 107-26+ 2.382 (proj of Dec 27 - Jan 19 - Feb 1 price swing), while a break here would open a move to 107-07+ (76.4% of the Oct - Dec ‘23 bull leg). While to the upside resistance holds at 109-02/26+ (Apr 8 low / Apr 10 high), a break back above here would open up 110-06 (Apr 4 high)

- Cash Treasury curve is slightly steeper today with yields 1-3bps lower, the 2Y yield is -2bps at 4.941%, 10Y -1.8bp to 4.569%, while the 2y10y is +0.104 at -37.542.

- (Bloomberg) Bonds Are Data Dependent Too as Yields March Higher (See link)

- Looking Ahead: Import Price Index, U. of Mich. Sentiment later tonight & Fed Speak

JGBS: Twist-Flattening, Light Domestic Calendar, Narrow Ranges

JGB futures are weaker, -6 compared to the settlement levels after dealing in a narrow range in today’s Tokyo session.

- Industrial Production was revised down to -0.6% in the final report. Capacity Utilisation fell 0.5% in February.

- (Bloomberg) Many Japanese companies are paying more to raise money from shorter-tenor notes as the Bank of Japan prepares to wind down corporate bond purchases as part of its historic move away from ultra-accommodative policy. (See link)

- Cash US tsys are dealing 1-2bps richer in today's Asia-Pac session after finishing Thursday with a slight twist-steepening.

- The cash JGB curve has twist-flattened, pivoting at the 5s, with yields 0.5bp higher to 4.0bps lower. The benchmark 10-year yield is 2.0bps lower at 0.851% versus the YTD high of 0.871% set yesterday.

- Swaps are richer, with rates 1-3bps lower across maturities. Swap spreads are tighter out to the 10-year and wider beyond.

- On Monday, the local calendar is light, with Core Machine Orders as the highlight.

AUSSIE BONDS: Cheaper, Narrow Ranges, Light Local Calendar, Jobs Report Next Thursday

ACGBs (YM -3.0 & XM -3.5) are holding cheaper after dealing in narrow ranges in today’s Sydney session. With the domestic data calendar light, local participants likely eyed US tsy dealings in today’s Asia-Pac session for directional guidance. Cash US tsys are 1-2bps richer, with a slight steepening bias.

- (AFR Joye) Equity and fixed-income investors were shocked during the week by the release of the official US inflation data, which confirmed a massive re-acceleration in services (rather than goods) inflation in March, with the annualised trend now running at an incredible 6.5 per cent (or 7.7 per cent if we exclude housing). (See link)

- Cash ACGBs are 3bps cheaper, with the AU-US 10-year yield differential 3bps lower at -28bps.

- Swap rates are 3.4bps higher, with the 3s/10s curve steeper.

- The bills strip has bear-steepened, with pricing -2 to -6.

- RBA-dated OIS pricing is 4-5bps firmer for 2025 meetings. A cumulative 17bps of easing is priced by year-end.

- The highlight of next week’s local calendar is the Employment Report for March on Thursday. The calendar is light until then.

- Next Wednesday, the AOFM plans to sell A$800mn of the 3.00% 21 November 2033 bond.

NZGBS: Closed At The Session’s Cheapest Levels, Q1 CPI Next Wednesday

NZGBs closed at the session’s cheapest levels, with benchmark yields 7-9bps higher. The NZGB 10-year underperformed its $-bloc counterparts, with the NZ-US and NZ-AU yield differentials 3bps wider at +27bps and +53bps respectively.

- Softer domestic data (Manufacturing PMI, Retail Card Spending and Food Prices) failed to support the market during the session.

- Cash US tsys are dealing 1-2bps richer in today's Asia-Pac session after finishing Thursday with a slight twist-steepening.

- Swap rates closed 8bps higher.

- For meetings beyond July, RBNZ dated OIS pricing is 2-8bps firmer today and 10-22bps firmer compared to levels before the RBNZ Decision on Wednesday.

- While the RBNZ maintained its tightening bias, the primary impetus behind this shift was a substantial reduction in market expectations for easing by the US Federal Reserve. This adjustment followed the release of stronger-than-expected US CPI data earlier in the week.

- Next week, the local calendar sees the Performance Services Index and Net Migration data on Monday ahead of REINZ House Sales, Non-Resident Bond Holdings and Q1 CPI data on Wednesday.

RBNZ: MNI RBNZ Review - April 2024: On Hold, Awaiting Further Data

- The RBNZ's April monetary policy decision delivered few surprises. The central bank noted: "Overall, members agreed that the balance of risks was little changed since the February Statement."

- The April policy meeting doesn’t deliver forecast updates, or a press conference. Hence it arguably saw little need to shift the tone of its statement ahead of the next policy meeting on the 22nd of May, particularly as the balanced of risks were seen as little changed relative to the February policy meeting.

- All in all, the RBNZ clearly sees it as being too early for a dovish shift in terms of the outlook. Whilst the bar to hike further is clearly elevated, the statement didn't give any hints that the restrictive policy stance will be changed in the near term. Ahead of the next policy meeting we have some key data points. Q1 CPI prints on Apr 17, so next Wednesday. Wages and employment figures are out on May 1, then inflation expectations on May 13.

- Full review here:

FOREX: USD Supported On Dips, Consolidating Strong Gains For The Week

The BBDXY has gravitated higher as the Friday Asia Pac session has unfolded. The Index was last near 1252.70, still sub intra-session highs from Thursday (~1253.7), but consolidating strong gains for the week (+0.80% at this stage).

- US cash Tsy yields sit 1-2bps lower across the benchmarks. News flow has been light but 10yr futures may be seeing some support around the 108 region, particularly in light of this week's sharp sell-off. US equity futures are close to flat, while regional equities are mixed.

- USD/JPY is close to flat, with lower US yields helping curb gains at the margin. The pair was last near 153.25, so still very close to recent highs (153.32). In the early part of trade we had further FX jawboning from FinMin Suzuki. The comments didn't shift yen sentiment though, with dips sub 153.00 supported.

- NZD/USD is around 0.6000, slightly outperforming most other pairs in the G10 space. We had softer PMI and card spending updates from earlier, suggesting a still challenged economic backdrop.

- AUD/USD is near 0.6530, down slightly for the session. Post US CPI lows just under 0.6500 remain intact. This week's sharp rise in US yields has offset a generally more favorable commodity price backdrop. Iron ore is back towards $109/ton.

- Looking ahead, UK growth data headlines the calendar on Friday, before UMich consumer sentiment and inflation expectations will be the US focus.

OIL: Nudging Higher, Middle East Tensions Remain In Focus

Brent crude is firmer in the first part of Friday trade, up around 0.60%, largely reversing losses from Thursday's session. We track near $90.25/bbl in recent dealings, which leaves us comfortably within recent ranges, although down on end levels from last week. The active WTI contract was last around $85.65/bbl.

- No military strikes from Iran or proxies yesterday helped take some of the risk premium out of oil. Reuters also reported that Iran will contain the fallout in its response to Israel (i.e. avoid a major escalation) and that its response will not be hasty (see this link).

- Still, other new outlets (WSJ) have stated Israel is preparing for a near term attack from Iran and/or it proxies. Market sentiment may be skewed towards not wanting to be short crude as we move towards the weekend, hence today's modest uptick.

- Elsewhere, OPEC maintained its oil demand growth forecast for 2024 and for 2025 steady, while slightly lowering the non-OPEC supply forecast for this year according to the latest OPEC Monthly Oil Market Report.

- US officials reportedly met with Venezuelan officials this week, with democratic reforms discussed ahead of deadline around US sanctions on the country's oil industry (see this BBG link). Later on, we hear from the IEA around the global oil balance backdrop.

- The technical settings for WTI remain unchanged, a bull theme remains intact.

GOLD: Yet Another All-Time High

Gold is 0.5% higher in the Asia-Pac session, after finishing 1.6% higher at $2372.52, a new closing high, on Thursday.

- Bullion showed resilience throughout the greenback rally on Wednesday while Thursday’s softer details in the US PPI report boosted the yellow metal.

- US tsys finished Thursday’s NY session with a slight twist-steepening of the curve after a volatile start following the ECB's steady rate announcement and the largely in-line US PPI data. PPI inflation missed at 0.15% m/m (0.3% est) in March, but core measures were in line.

- Initial Jobless Claims fell 11k last week to 211k, just below expectations, but with seasonal factors around the timing of Easter still likely playing a role.

- The US 2-year finished 1bp richer, with the 10-year yield 4bps cheaper at 4.59%.

- Fed Collins and Fed Williams said it may take more time to gain the confidence to begin easing policy. Williams: “There’s no clear need to adjust monetary policy in the very near term”.

- According to MNI’s technicals team, the latest climb maintains the bullish price sequence of higher highs and higher lows and note that moving average studies are in a bull-mode condition, reflecting positive market sentiment. The $2300.0 handle has been cleared. The next objective is $2376.5, a Fibonacci projection.

ASIA EQUITY FLOWS: Asian Equity Flows Mixed,Short Term Trend Negative,SK The Exception

- China equity flows continue to see-saw, with a 2b yuan inflow on Thursday, taking the past 5 trading days to a net outflow of 6.4b. Equities closed mixed as China’s consumer prices barely increased from a year earlier and industrial prices continued to slump, underscoring the deflationary pressures that remain a key threat to the economy’s recovery. The 5-day average is -1.27b, below both the 20-day average of 1.22b and the 100-day average of 0.32b yuan.

- Taiwan equities were mostly unchanged on Thursday, as the market looks to take a break. The Taiex is up 16% for the year, with most of those gains coming from AI linked stocks and in particular TSMC which has contributed to about 60% of the Taiex gains this year while Hon Hai accounted for 8% and Quanta Computers 2.5%. The countries Government officials have been continually warning investors about chasing equities prices higher. In the short-term Taiwan equity markets have seen the largest amount of selling from foreign investors in the region, which also coincides with when the warnings about equity prices being at stretched valuations from government officials started. The 5-day average is now -$173, the 20-day average is -$210m while the longer term 100-day average is still positive sitting at $164m.

- South Korea opened trading on Thursday lower after returning from a public holiday on Wednesday, where the President suffered a lost in the parliamentary elections. The Kospi gapped lower on the open, down 1.60% and tapping the 50-day EMA before an impressive reversal as invested digested the election impact and viewed that the impact of a setback for the President party would be short-lived with the markets finishing the session up 0.07%. There was $758m in inflows from foreign investors, the largest since 21st March, while the 5-day average is now $271m, just below the 20-day average of $285m, both comfortably above the longer term 100-day average of $190m Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | 2.0 | -6.4 | 60.2 |

| South Korea (USDmn) | 759 | 1359 | 14343 |

| Taiwan (USDmn) | -296 | -867 | 4375 |

| India (USDmn)** | 1023 | 932 | 2290 |

| Indonesia (USDmn) **** | 0 | -488 | 1102 |

| Thailand (USDmn) | -50 | 243 | -1666 |

| Malaysia (USDmn) *** | -23 | -113 | -292 |

| Philippines (USDmn) | -4 | -51.6 | 133 |

| Total (Ex China USDmn) | 1410 | 1013 | 20285 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To Apr 8th | |||

| *** Data Up To Apr 9th | |||

| **** Close for Public Holiday |

ASIA STOCKS: Hong Kong & China Equities Lower, HSI Below 17,000, Property Falls

Hong Kong and China equity markets are lower today with tech names leading the decline, while Asian EV makers dip after Ford’s move to slash prices on its electric pickup truck sparked a selloff in shares of US startups, Chinese property developers extend declines, led by Shimao Group and China Vanke, as prolonged weakness in home sales, cash crunch and a lack of progress in restructuring sour investors’ sentiment, while the surge in Gold recently has helped Chinese Gold producers.

- Hong Kong equities are lower today, the HSTech Index has been range bound recently trading between 3,400 and 3,600 the index is down 1.08% for the day, the Mainland Property Index is down 3.05% while the wider HSI is down 1.73% and is now on track to close the week below 17,000 which would send a negative signal across local stocks. In China, equity markets are faring slightly better with the CSI300 off 0.28%, the CSI1000 is down 0.33% and the ChiNext is down 0.67%.

- China Northbound saw 2b of inflows on Thursday, with the 5-day average at -1.27billion, while the 20-day average sits at 1.12billion yuan.

- In the property space, many Chinese cities have recently implemented targeted easing measures in their housing markets, with 15 cities removing the lower limit for mortgage rates on first-home purchases, including Guangzhou, and four cities relaxing housing provident fund policies.

- (Bloomberg) Chinese Developers Fall as Liquidity Concerns Weigh Sentiment (See link)

- China is reducing its copper smelting output due to declining margins amidst a surge in global prices, with treatment and refining charges collapsing to near zero levels. Approximately 8.5% of the country's smelters were inactive in the first quarter, up from 4.1% a year earlier, as ore supply shortages and increased domestic capacity intensify competition. The situation poses production challenges for smelters aiming to protect their margins amid insufficient ore supplies caused by output reductions at major global producers like First Quantum Minerals Ltd. and Anglo American Plc.

- Apple is gearing up to revamp its entire Mac lineup with a new family of in-house processors, the M4 chips, designed to showcase artificial intelligence capabilities. The company aims to address sluggish computer sales by integrating AI features into its products, with plans to release updated computers starting late this year. This shift to in-house chips continues Apple's long-running initiative, known as Apple Silicon, aimed at unifying hardware and software while reducing reliance on processors made by Intel. The move is likely to impact Intel, as Apple shifts away from its processors, potentially affecting the broader semiconductor industry landscape.

- Looking ahead, China Trade Balance data is expected at 5pm AEST

ASIA PAC STOCKS: Asian Equities Mixed, Japan Equities Outperform As Yen Weakens

Regional Asian equities mixed on Friday, US equities markets rallied on mixed PPI overnight, as tech outperformed after Apple announced it is preparing to overhaul its Mac line with new in-house processors highlighting AI, while earnings will kick off later today with JPM and Citigroup reporting. Japan is the top performing market in the region, Feb Industrial Production fell to -3.9% from -3.4% y/y, South Korea's unemployment rate rose in March and BOK has kept rates on hold, New Zealand saw PMI decline in March, while card spending and Food prices ticked higher in March.

- Japan equities are higher today and now heading for a weekly rebound as tech shares followed their overseas peers higher amid optimism a solid US economy will fuel a rise in profit growth for S&P 500 companies. The yen has began to slip to lows again, Investors will continue to closely watch the currency once more as Japanese authorities warned that it will consider all options to combat weakness. Most sectors are higher this morning with Banks the exception the Topix Bank Index down 0.51%, while the wider Topix Index is up 0.42% and the Tech heavy Nikkei 225 is up 0.34%

- South Korean equities are lower today, the unemployment rate rose in March to 2.8% from 2.6% in Feb, while the BOK has kept rates on hold at 3.50%. Equity flow momentum remains strong and is by far seeing the most inflow from foreign investors in the region, with 1.35b of inflows over the past 5 trading days. The Kospi is down 0.87%.

- Taiwan equities are slightly higher today, equity flow momentum is negative in the short-term with the 5-day average now -$173m, and the 20-day average now -$210m. Taiwan has a quiet week ahead in terms of economic data released with the next released not until Apr 22 when the unemployment data is released. Focus will largely be on whether the recent rally continues and if government officials continue to warn local investors about chasing stretched valuations. The Taiex is up 0.28% today and 16% for the year with the majority of those gains coming from just three stocks with TSMC contributing about 60%, Hon Hai accounting for 8% and Quanta Computers 2.5%.

- Australian equities have opened lower today, with miners and energy shares weighing on the market, while Health care and Tech trade higher. The ASX200 is trading just on the 20-day EMA which could lend some support to the market. There is little in the way of economic data until employment data on Thursday. The ASX200 is down 0.34% at 7,785.

- Elsewhere in SEA, New Zealand equities are down 0.34% after earlier saw PMI fall to 47.1 from 49.3 in Feb, while Food prices rose to -0.5% in Mar from -0.6% m/m in Feb. Singapore equities are down 0.30% after GDP missed expectations coming in at 2.7% vs 3.0% y/y, while MAS kept policy rates unchanged. Philippines equities are up 0.30%, Malaysian equities are down 0.20% while India equities are down 0.50%.

SOUTH KOREA: H2 Cut Possible-Inflation Key, Fed Outcomes & USD/KRW Not Key Policy Determinants

The BoK held rates at 3.50%, as widely expected by the sell-side consensus, along with our own bias. The accompanying statement did contain some dovish leanings from the BoK. Most notably the central bank removed the wording 'long' in reference to maintaining restrictive policy for a sufficient period of time. The prior statement in Feb had noted that the restrictive policy settings would be maintained for a 'long period' of time.

- The statement noted inflation is expected to moderate in both core and headline terms to around 2% (for core) by the end of this year. However, significant uncertainties remain, particularly in terms of agricultural prices and the oil price outlook.

- There are modest upside risks to the growth forecast of 2.1% (made in Feb), due to exports picking up stronger than expected.

- In the press conference Governor Rhee, noted 5 board members saw the policy rate at 3.5% in 3 months time, while one board member was open to a cut over this time period.

- Governor Rhee stated that if inflation pans out as projected then a H2 cut can't be ruled out. However, if inflation is above 2.3% late this year, a cut will be difficult.

- Governor Rhee stated the central bank will likely have a clearer picture after the May meeting, when forecasts are updated. Still, a cut may not materialize straight after this, as developments will still need to be monitored.

- Rhee didn't stress a need to move after the US Fed has eased, saying the BoK has become more independent of US monetary policy. He also appeared reasonably relaxed around the FX backdrop. Rhee stated that Korea is not the only country experiencing FX weakness and that the authorities had the ability to deal with herd behaviour in FX markets.

- The outcome came across as more dovish than we had expected. Whilst clearly the inflation outlook is key, the BoK is certainly open to easier settings in H2 and will not be constrained by what the Fed does or doesn't do, likewise in terms of the USD/KRW trajectory.

SINGAPORE: MAS Maintains Policy Settings, As Expected, Q1 GDP Below Expectations

As widely expected, the MAS maintained its current policy settings. The prevailing rate of S$NEER appreciation was maintained, while there were no changes to its width or the level at which it is centred. See this link for the full policy statement.

- Broader economic trends continue to evolve as the MAS expects. Economic growth is projected at 1-3% this year, the same as the forecast made in January. The inflation outlook was also the same as from the January policy meeting. Core inflation and headline inflation are forecast at 2.5-3.5%.

- Current policy settings are to be maintained to ensure a dampening of imported inflation and curbing of domestic price pressures.

- Core inflation is likely to remain elevated in the near term before falling in Q4 and then stepping down further in 2025. Our sense is that this is likely to dictate the timing of any policy easing, or reduced tightening by the MAS (outside of an economic shock).

- For growth, the recovery is expected is expected to broaden as 2024 unfolds and the slightly negative output gap from 2023 is expected to narrow as we progress through this year. However, this is not expected to add to inflationary pressures.

- Q1 GDP data came in weaker than expected (0.1% q/q, versus 0.5% forecast and 2.7% y/y, versus 3.0% forecast). the MAS noted, "Manufacturing and modern services activity saw some slowing in Q1 2024 after having expanded strongly in the preceding quarters. Growth in the consumer-facing sectors picked up in Q1, reflecting in part the boost from an increase in tourist arrivals."

- USD/SGD sits a touch higher post the meeting outcome, last near 1.35/3540, but broader USD sentiment has ticked higher in recent dealings. We are just shy of multi month highs above 1.3550. For the S$NEER, the Goldman Sachs Index remains close to -0.55% from the top end of the band, which is where we were prior to the policy outcome.

ASIA FX: USD/Asia Pairs Higher, Won Weakens Amid Dovish BoK Signals

Most USD/Asia pairs are higher, although USD/CNH has tracked sideways. Spot won has been the weakest performer, with dovish BoK signals weighing on sentiment. MYR has also weakened as onshore markets returned. USD/SGD is higher, but SGD is not underperforming the rest of the region. The MAS maintaining tightening settings at today's policy meeting. Still to come is China trade data for Mar, while in India we see Feb IP and Mar CPI print later on.

- USD/CNH hasn't drifted too far away from the 7.2550 level, while onshore spot has been steady near 7.2370. the CNY fixing was little changed from yesterday's outcome and remains sub 7.1000, thereby capping USD/CNY upside. Local equities are weaker, but this hasn't impacted sentiment much today. We still have March trade figures due, while we still wait for Mar new loans/aggregate financing data as well.

- Spot USD/KRW has broken to fresh multi year highs, the pair last near 1374. The 1month NDF is around 1372. A slightly dovish undertone from the BoK (post an unchanged rate_)and not a great deal of concern around recent FX weakness, has likely aided higher USD/KRW levels. Importantly, BoK Governor Rhee noted the central bank can move independently of the Fed decisions. Still, the inflation trajectory is key to the rates outlook. Some local equity market weakness, the Kospi down, 0.80%, underperforming better US tech tones, is also an additional headwind. For the 1 month NDF, a clear break above 1370, could see 1383 targeted (Nov 10 2022 highs). Beyond that lies the 1400 level.

- As widely expected, the MAS maintained its current policy settings. The prevailing rate of S$NEER appreciation was maintained, while there were no changes to its width or the level at which it is centred. Q1 GDP data came in weaker than expected (0.1% q/q, versus 0.5% forecast and 2.7% y/y, versus 3.0% forecast). USD/SGD sits a touch higher post the meeting outcome, last near 1.3555 but broader USD sentiment has ticked higher as the session has progressed. For the S$NEER, the Goldman Sachs Index remains around -0.65% from the top end of the band, slightly weaker compared to levels prior to the policy outcome.

- USD/MYR has been on the front foot as onshore markets return after being out for the prior two sessions. This is clearly some catch up to USD strength, particularly post the CPI print on Wednesday. The pair was last 4.7680. Earlier highs were at 4.7775 per BBG. This puts us back close to the 4.8000+ highs from mid-February which drew a response from the authorities. There were efforts to encourage repatriation of offshore earnings and conversion into MYR, particularly from state-owned enterprises.

- Indonesian markets remain closed until next Tuesday. The 1 month NDF for USD/IDR is continuing to climb though. The pair last around the 16100 level (per BBG). This is fresh highs back to early 2020 for the pair. Paring of Fed rate expectations this week, post the CPI print has clearly weighing on IDR sentiment.

PHILIPPINES: Sov Curve Steepens, US Plans Chips & Nickel Deal With Philippines

- Curve have bull-steepened today, as yields continue to edge higher post US CPI, the 2Y yield is 2bps lower at 4.98%, 5Y yield is 1bps higher at 5.23%, 10Y yield is 2bp higher at 5.31%, while 5yr CDS is 1bp higher to 65bps.

- Looking back over the week the 2y is 18bps higher, 5y is 23bps higher, while the 10y 21bps higher.

- The Philip to US Treasury spread difference has tighten over the past week with the front-end & long-end is now at the tightest levels since June 2023, the belly of the curve lags with the 5-7yr area off YtD tights, the 2y is 4.5bps (+0.5bp), the 5yr is 62bps (+2bps), while the 10yr is 74bps (-1bp).

- Cross-asset moves: the USD/PHP is unchanged at 56.493, PSEi Index is 0.40% lower, Corporate Credit curve is 7-17bps higher over the week with the front-end selling off, while US Tsys yields are 1-3bps lower as the curve steepens.

- (Bloomberg) Biden Vows to Back Japan, Philippines as China Jolts Allies (See link)

- (Bloomberg) US Plans Chips, Nickel Deals in Philippines as Defense Ties Grow (See link)

- Looking Ahead, Overseas Cash Remittances on Monday

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/04/2024 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/04/2024 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/04/2024 | 0600/0700 | ** |  | UK | Index of Services |

| 12/04/2024 | 0600/0700 | *** |  | UK | Index of Production |

| 12/04/2024 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/04/2024 | 0600/0800 | *** |  | DE | HICP (f) |

| 12/04/2024 | 0600/0800 | *** |  | SE | Inflation Report |

| 12/04/2024 | 0600/0700 |  | UK | BOE's Greene Panellist at Delphi Economic Forum on US vs Europe Growth | |

| 12/04/2024 | 0645/0845 | *** |  | FR | HICP (f) |

| 12/04/2024 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/04/2024 | 1100/1200 |  | UK | BOE's Bernanke Review of Forecasting for Monetary Policymaking | |

| 12/04/2024 | 1100/1300 |  | EU | ECB's Elderson Speaks At Delphi Economic Forum | |

| 12/04/2024 | - | *** |  | CN | Trade |

| 12/04/2024 | 1200/0800 |  | US | San Francisco Fed's Mary Daly | |

| 12/04/2024 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 12/04/2024 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 12/04/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 12/04/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 12/04/2024 | 1700/1300 |  | US | Kansas City Fed's Jeff Schmid | |

| 12/04/2024 | 1830/1430 |  | US | Atlanta Fed's Raphael Bostic | |

| 12/04/2024 | 1930/1530 |  | US | San Francisco Fed's Mary Daly |