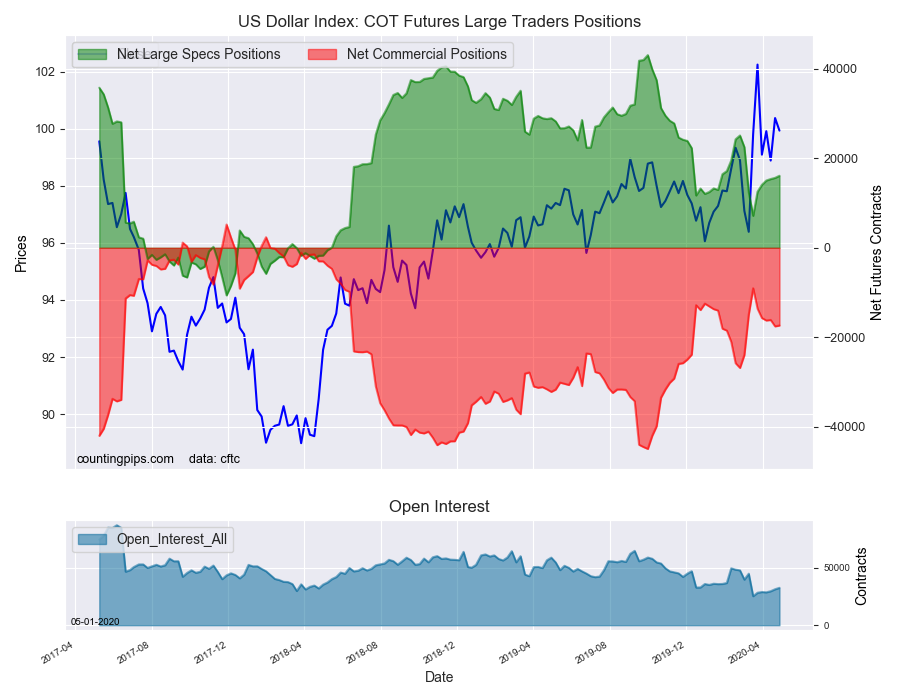

US Dollar Index Speculator Positions

Large currency speculators lifted their bullish net positions in the US Dollar Index futures markets once again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 16,088 contracts in the data reported through Tuesday, April 28th. This was a weekly tick higher by 472 contracts from the previous week which had a total of 15,616 net contracts.

This week’s net position was the result of the gross bullish position (longs) gaining by 1,425 contracts (to a weekly total of 26,269 contracts) compared to the gross bearish position (shorts) which saw a gain by a lower amount of 953 contracts on the week (to a total of 10,181 contracts).

The US Dollar Index speculators edged their bullish positions higher for the sixth straight week and bets have now gained by a modest total of +8,936 contracts over that time-frame. These increases have pushed the current standing to the highest level of the past eight weeks. Speculator bullish sentiment has been slow but steadily rising in recent weeks while the dollar index price level has been in a range between 98.50 on the low side and 100.50 on the high side.

Individual Currencies Data this week:

In the other major currency contracts data, the biggest movements we saw in the speculators category this week were gains in the Japanese yen and Mexican peso while declines were seen in the euro, British pound and the Canadian dollar.

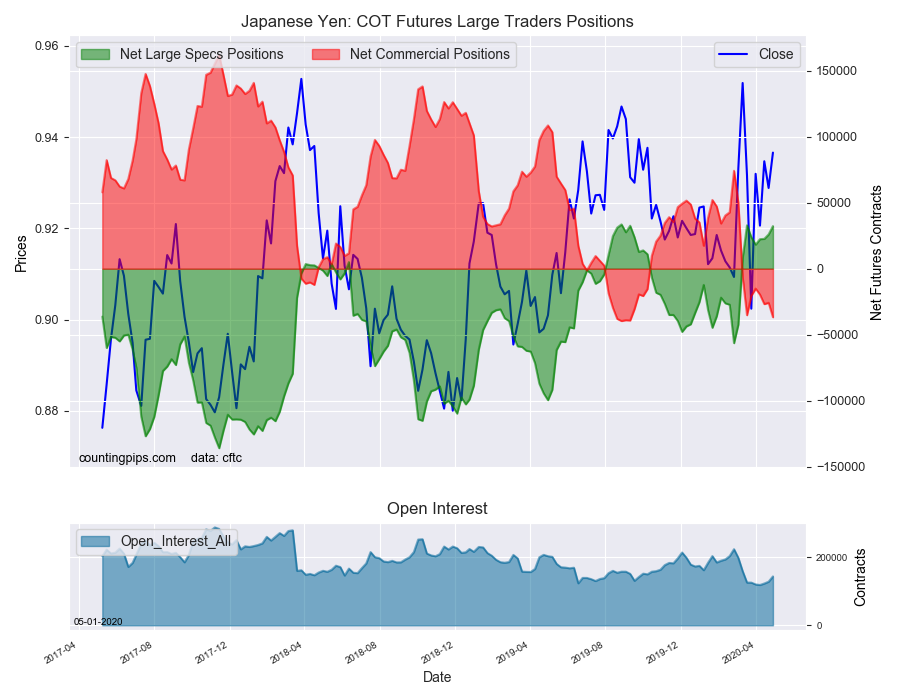

Japanese yen speculator bets rose for a fourth straight week this week and have now gained by a total of +14,044 contracts over that period. The yen position has been in bullish territory for eight straight weeks after turning positive on March 10th and this week marked the first time bets have been above +30,000 net contracts since March 17th.

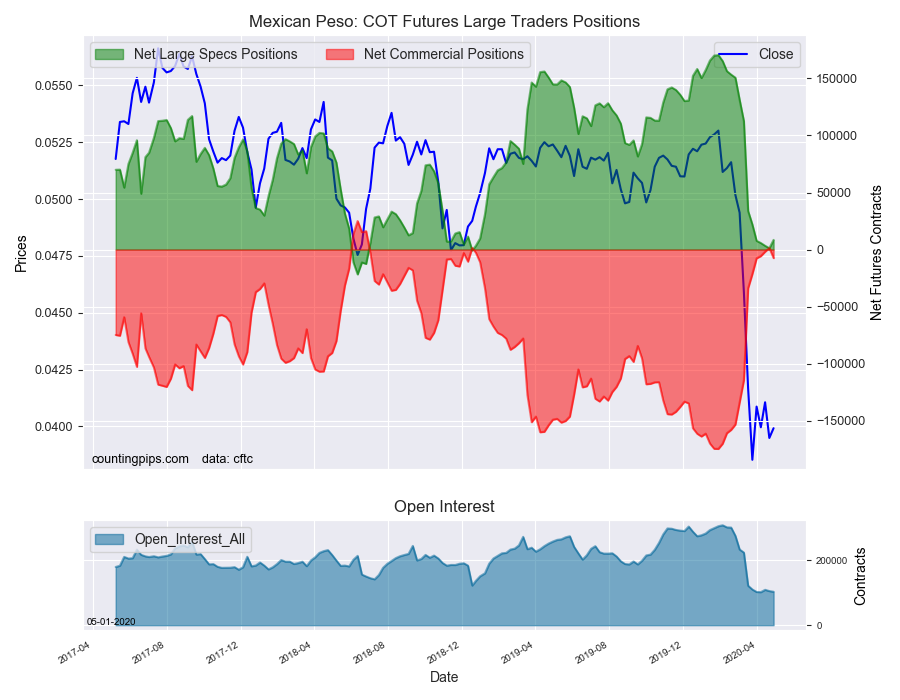

Mexican peso bullish positions rose this week for the first time following twelve straight down weeks. The down-streak started after bullish bets hit an all-time record high of +170,366 contracts on January 28th. Since then, the speculator’s bullish position shed a total of -169,126 contracts before this week’s turnaround. The peso position has remained in bullish territory overall for seventy-one straight weeks, dating back to December of 2018.

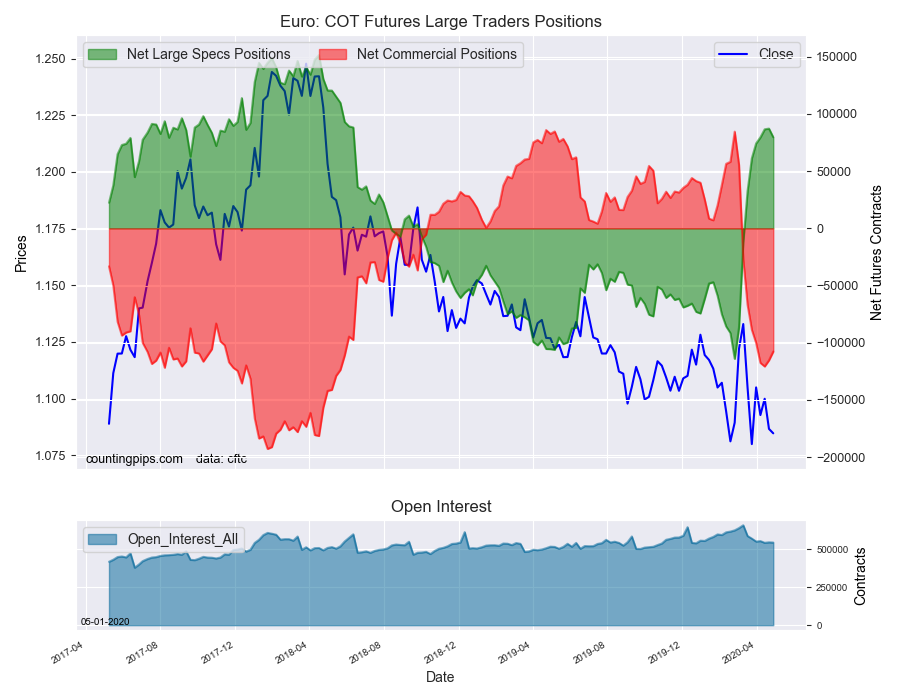

Euro speculative bets fell this week following eight straight weeks of gains. The euro position had reached a recent bearish high of -114,021 contracts on February 25th before speculators bailed out of their short positions and started a reversal the other way. This turnaround brought the bullish position to a high of +87,218 contracts last week and before this week’s cool off. Despite these gains in euro bets, the sentiment failed to benefit the EURUSD much as the currency pair has remained below the 1.10 exchange rate for most of the past five weeks.

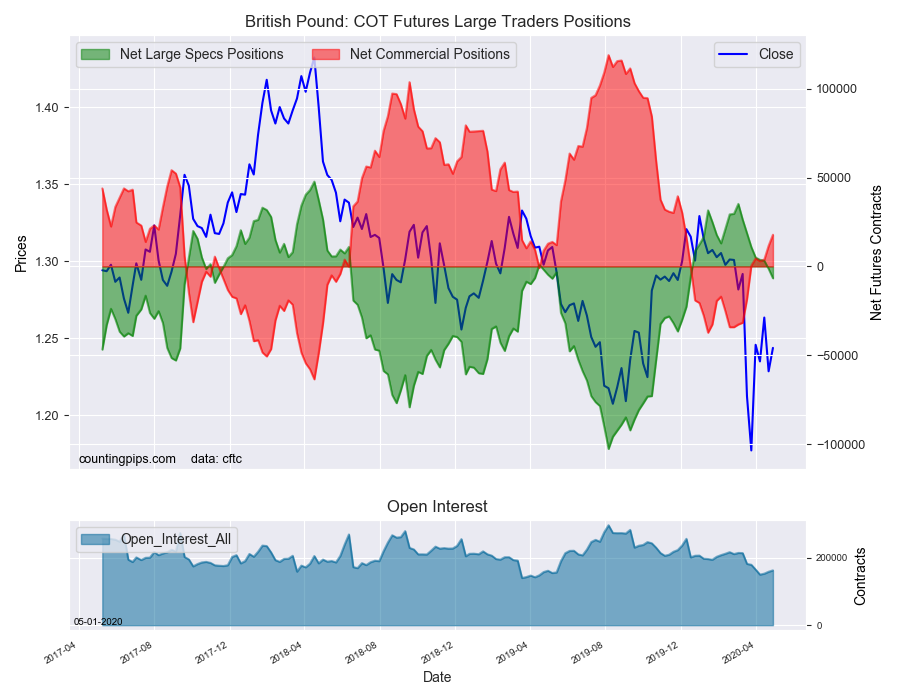

British pound sterling speculative positions fell for the eighth straight week this week. The GBP had risen to an overall bullish position on December 24th and had maintained that bullish sentiment for the next seventeen weeks with a recent high of +35,162 contracts on March 3rd. Following that March 3rd level, the speculative trader position reversed course with consecutive weeks of negative bets that culminated with a cross into bearish territory on April 24th and further this week. The GBPUSD currency pair, meanwhile, has been in a range between approximately 1.2200 and 1.2630 in the past five weeks after a short spell around 1.15 in mid-to-late March.

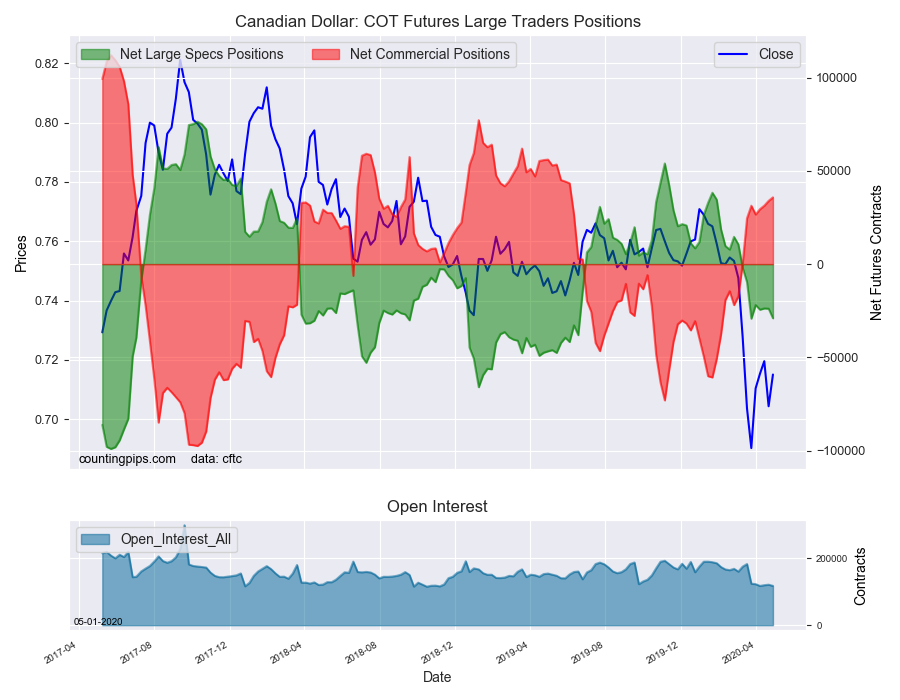

Canadian dollar speculator bets declined this week for a second straight week and for the eleventh time out of the past fourteen weeks. The overall standing remains in bearish territory at a total of -29,044 contracts and has now been above the -20,000 net contract level for six straight weeks. The CAD speculator position had been in bullish territory for thirty-six straight weeks before falling into a bearish standing on March 17th. The USD/CAD currency pair has seen the CAD weaker as the USDCAD is trading over the 1.40 exchange rate for the seventh week.

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (472 weekly change in contracts), Japanese yen (6,300 contracts), Swiss franc (652 contracts), New Zealand dollar (480 contracts) and the Mexican peso (7,241 contracts).

The currencies whose speculative bets declined this week were the euro (-7,537 weekly change in contracts), British pound sterling (-5,301 contracts), Canadian dollar (-5,153 contracts) and the Australian dollar (-2,921 contracts).

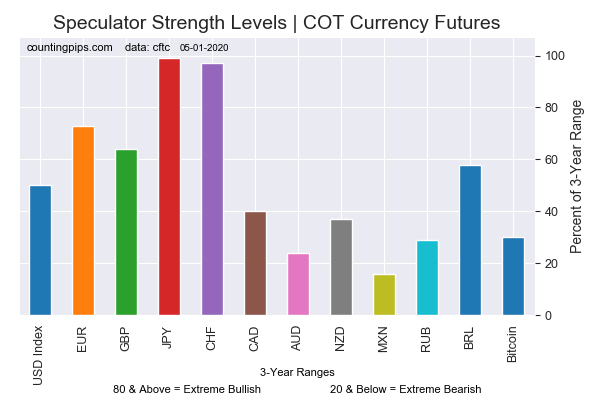

Chart: Current Strength of Each Currency compared to their 3-Year Range

The above chart depicts each currency’s current speculator strength level compared to data of the past 3 years. A score of 0 percent would mean speculator bets are currently at the lowest level of the past three years. A 100 percent score would be at the highest level while a 50 percent score would mean speculator bets are right in the middle of the data (a neutral score). We use above 80 percent (extreme bullish) and below 20 percent (extreme bearish) as extreme score measurements.

Please see the data table and individual currency charts below.

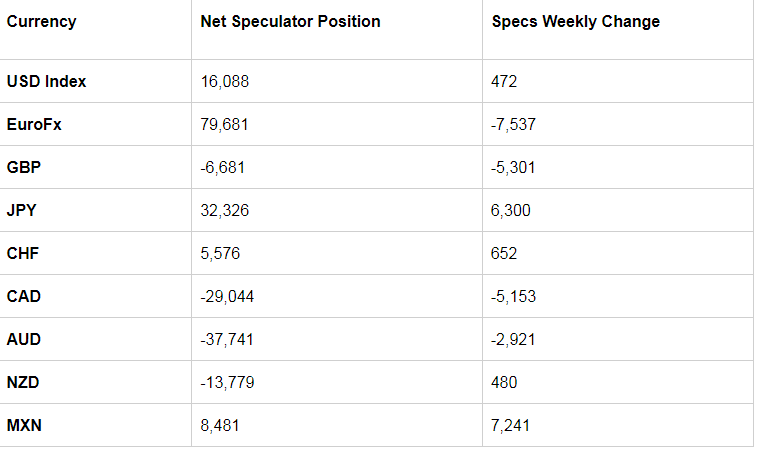

Table of Large Speculator Levels & Weekly Changes:

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

The Euro large speculator standing this week was a net position of 79,681 contracts in the data reported through Tuesday. This was a weekly decline of -7,537 contracts from the previous week which had a total of 87,218 net contracts.

British Pound Sterling:

The large British pound sterling speculator level recorded a net position of -6,681 contracts in the data reported this week. This was a weekly decrease of -5,301 contracts from the previous week which had a total of -1,380 net contracts.

Japanese Yen:

Large Japanese yen speculators equaled a net position of 32,326 contracts in this week’s data. This was a weekly increase of 6,300 contracts from the previous week which had a total of 26,026 net contracts.

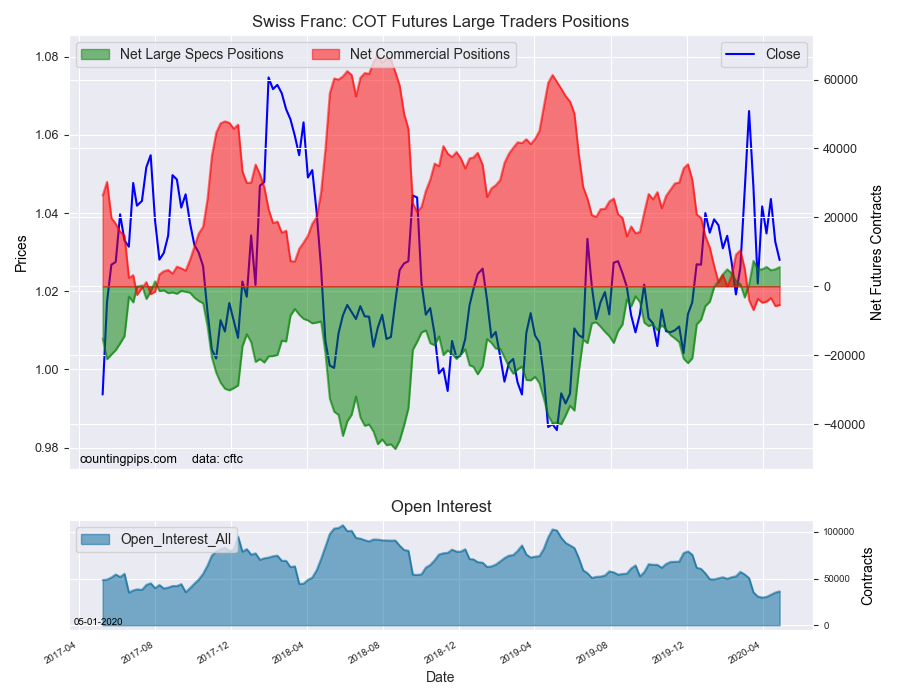

Swiss Franc:

The Swiss franc speculator standing this week recorded a net position of 5,576 contracts in the data through Tuesday. This was a weekly advance of 652 contracts from the previous week which had a total of 4,924 net contracts.

Canadian Dollar:

Canadian dollar speculators recorded a net position of -29,044 contracts this week. This was a reduction of -5,153 contracts from the previous week which had a total of -23,891 net contracts.

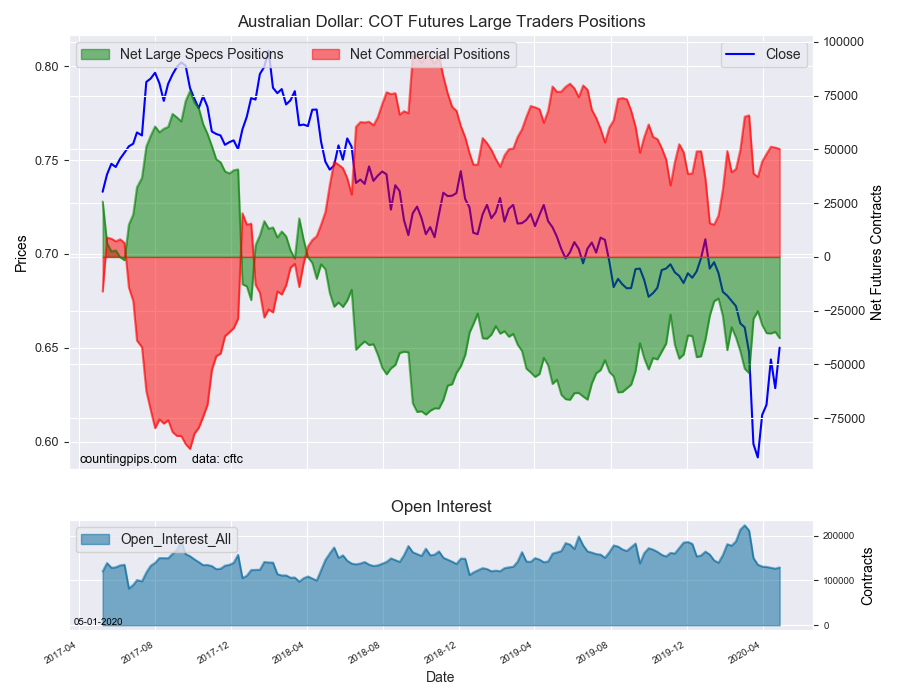

Australian Dollar:

The large speculator positions in Australian dollar futures totaled a net position of -37,741 contracts this week in the data ending Tuesday. This was a weekly decrease of -2,921 contracts from the previous week which had a total of -34,820 net contracts.

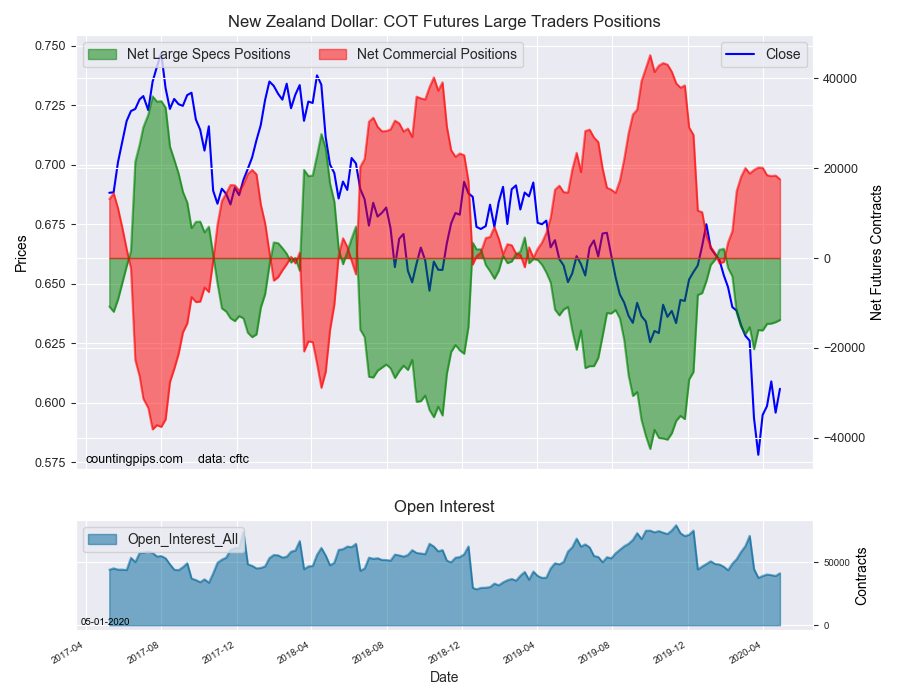

New Zealand Dollar:

The New Zealand dollar speculative standing resulted in a net position of -13,779 contracts this week in the latest COT data. This was a weekly boost of 480 contracts from the previous week which had a total of -14,259 net contracts.

Mexican Peso:

Mexican peso speculators was a net position of 8,481 contracts this week. This was a weekly gain of 7,241 contracts from the previous week which had a total of 1,240 net contracts.