- India

- International

Demonetisation facts: Over 99% of banned notes are back, cash at home at 7-year high

Just Rs 10,720 crore of Rs 500 and Rs 1,000 notes failed to come back to the RBI, as against expectations that over Rs 3 lakh crore of black money would not return to the banking system.

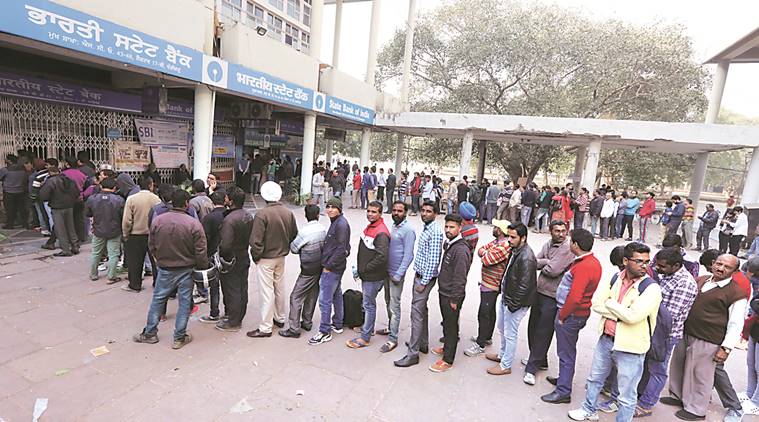

Demonetisation led to long queues outside banks. (File Photo)

Demonetisation led to long queues outside banks. (File Photo)

Over 21 months after Rs 500 and Rs 1,000 notes were withdrawn from circulation on November 8, 2016, the Reserve Bank of India (RBI) on Wednesday said that nearly all of that money has returned to the banking system.

The RBI has received Rs 15.31 lakh crore of Rs 500 and Rs 1,000 notes, or 99.3 per cent of the Rs 15.417 lakh crore worth of notes which were in circulation as on November 8, 2016, when the government announced demonetisation, the central bank said in its annual report for 2017-18 released on Wednesday.

This means that just Rs 10,720 crore of Rs 500 and Rs 1,000 notes failed to come back to the RBI, as against expectations that over Rs 3 lakh crore of black money would not return to the banking system.

The sudden withdrawal of notes in 2016 had created a liquidity shortage, with long queues outside banks and people undergoing immense hardship across the country. It had also roiled the economy, with demand falling, businesses facing a crisis, and GDP growth declining close to 1.5 per cent. Many small units were hit hard, with many reporting huge losses even after nine months.

READ | Govt claims demonetisation achieved its objective, Oppn asks where is black money

The RBI had introduced new Rs 500 and Rs 2,000 notes in place of the notes withdrawn from the system, but the pace of remonetisation was slow. The total expenditure incurred on security printing during the year (July 2017-June 2018) stood at Rs 4,912 crore, as against Rs 7,965 crore in 2016-17, the RBI said.

“This humongous task of processing and verification of SBNs (specified bank notes) was successfully achieved with the coordinated efforts put in by the work force of the Issue Department of the Reserve Bank,” said the report. The SBNs received were verified, counted and processed in the sophisticated high speed CVPS (currency verification and processing system) for accuracy and genuineness, and shredded and briquetted in the shredding and briquetting system, it said.

“The total value of SBNs in circulation as on November 8, 2016, post verification and reconciliation, was Rs 15,41,793 crore. The total value of SBNs returned from circulation is Rs 15,31,073 lakh crore,” the central bank said.

Criticising the demonetisation exercise, former Finance Minister P Chidambaram said: “Every rupee of the Rs 15.42 lakh crore has come back to the RBI. Remember who had said that Rs 3 lakh crore will not come back and that will be a gain for the government? I suspect that the bulk of the currency (Rs 10,720 crore) was in Nepal and Bhutan and some of that was lost or destroyed.”

Stating that the country paid a huge price for demonetisation, he said: “Over 100 lives were lost, 15 crore daily wage earners lost their livelihood for several weeks. Thousands of SME units were shut down. Lakhs of jobs were destroyed. Indian economy lost 1.5 per cent of GDP in terms of growth. That alone was a loss of Rs 2.25 lakh crore a year.”

In August 2017, while defending demonetisation, the government had said that close to Rs 3 lakh crore, which was earlier not part of the banking system, had been deposited in banks. Over Rs 2 lakh crore of black money reached banks, while around Rs 1.75 lakh crore deposited by people post-note ban was under suspicion, it had said, adding that around 18 lakh people with disproportionate income were under government scrutiny. The government, while announcing demonetisation, had also cited checking counterfeit notes as one of the reasons.

Department of Economic Affairs Secretary Subhash Chandra Garg said the demonetisation process has achieved its objectives of reducing black money, fake currency, terrorist financing and promoting digital transactions. “I think demonetisation achieved its objectives quite substantially,” he said. “The currency in the system now is 87-88 per cent, that is about Rs 3-4 lakh crore less currency than it would have been if the system would have continued in the old manner,” he said.

The overall notes in circulation added up to Rs 18.03 lakh crore as on March 2018, displaying a growth of 9.9 per cent over March 2016. “The value share of high denomination currency (Rs 500 and Rs 2,000 notes) in overall currency composition in March 2018 was 80.6 per cent, which is lower than it was in the pre-demonetisation period (86.4 per cent). Thus, there is a 5.8 per cent, or Rs 1 lakh crore, shift in favour of small denomination currency notes,” said Soumya Kanti Ghosh, Group Chief Economic Adviser, SBI.

Must Read

Apr 23: Latest News

- 01

- 02

- 03

- 04

- 05